Table of Contents

Tangerine offers two of the most underrated cashback credit cards in Canada, the no-annual-fee Tangerine® Money-Back World Mastercard®* and the Tangerine Money-Back Credit Card. In a market crowded with travel rewards and annual-fee powerhouses, Tangerine’s credit cards offer a no-nonsense approach to earning cashback on the everyday spending that makes up most of our monthly budgets.

While both cards earn unlimited 2% cash back in up to 3 categories of your choice, new cardmembers can get an additional $120 bonus with the Money-Back World Mastercard, and a bonus 10% cash back with the Money-Back credit card. Both elevated offers are available until April 30, 2026, and each comes with specific requirements. Let’s take a closer look at the benefits and the requirements.

Tangerine® Money-Back World Mastercard® – Apply Now

- Annual Fee: No annual fee

- Purchase Interest: 20.95%

- Cash Advance Interest: 22.95%

- Welcome Bonus: Get a $120 bonus with a spend of $1,500 in the first 3 months (Apply by April 30, 2026)

- Earning Rate:

- Unlimited 2% cash back on purchases in two categories of your choice.

- Unlock a third 2% category when your cash back Reward is deposited in a Tangerine Savings Account.

- 0.5% on everything else

- Other Key Benefits:

- FlexiRoam: Complimentary 1GB Global Data Roaming Plan and 15% off on purchase of Data Plans.

- Purchase Assurance and Extended Warranty: lifetime maximum of $60,000.

- Mobile Device Insurance: Up to $1,000 coverage of your mobile device.

- Rental Car Insurance: Get Damage and theft protection for car rentals.

- Add up to 5 authorized users to your account

A detailed list of benefits and perks of the card is listed here

Tangerine Money-Back Credit Card – Apply Now

- Annual Fee: No annual fee

- Welcome Bonus: Extra 10% Cash Back (up to $100) on everyday purchases within your first 2 months (Apply by April 30, 2026)

- Earning Rate:

- Unlimited 2% money-back on two categories

- Unlock a third 2% category when your cash back Reward is deposited in a Tangerine Savings Account.

- 0.5% on everything else

- Other Benefits:

- Low promotional interest rate of 1.95% on balance transfers for 6 months (and 22.95% on any unpaid balances after 6 months). A 1% Balance Transfer Fee will apply to the amount transferred.

- Add up to 5 authorized users to your account

- Purchase Assurance and Extended Warranty: lifetime maximum of $60,000.

A detailed list of benefits and perks of the card is listed here

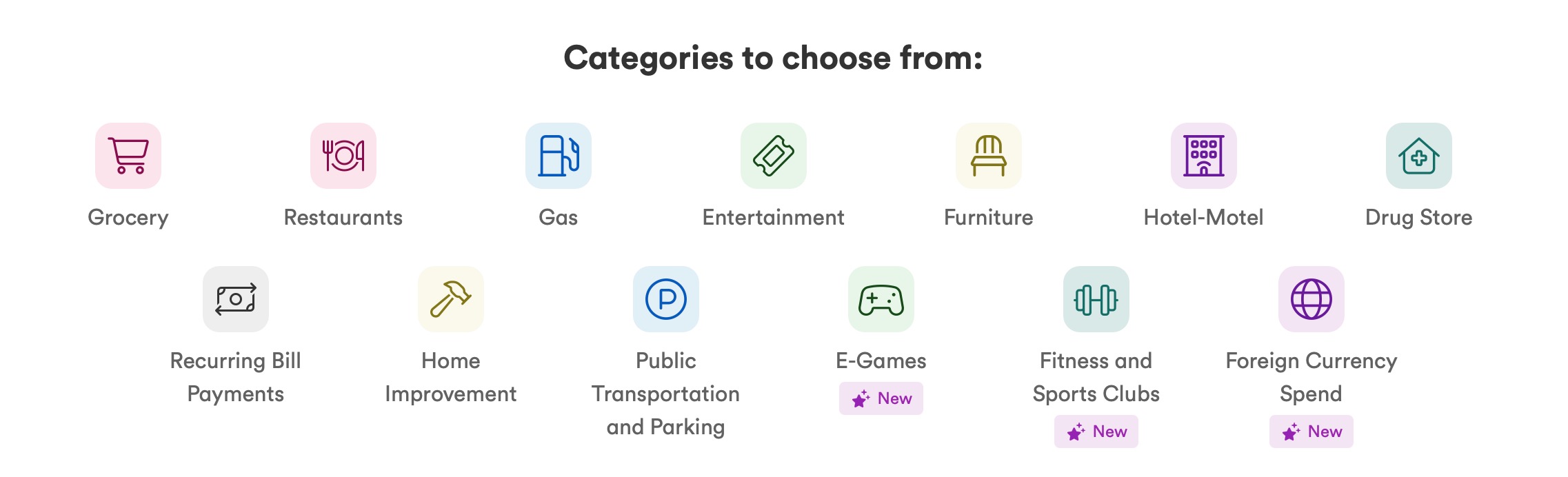

Tangerine Cashback Categories

Cardmembers can choose up to three 2% categories to maximize their unlimited cash back on their most frequent purchases, such as groceries or gas. You can change them to match your spending habits every 90 days. The new ‘Foreign Currency spend’ category can be valuable for the casual traveller looking to offset the typical 2.5% FX fee. For a no-annual-fee card, this is an impressive perk.

Whether you’re just beginning your rewards journey or looking to streamline your wallet, Tangerine credit cards prove that you don’t need to chase points to get meaningful returns. Unlimited 2% cash-back (deposited monthly) on up to 3 categories is a compelling reason to hold the card for your household expenses.

Title Image Credit: Tangerine