Table of Contents

Points Miles and Bling (blog) contains referral or affiliate links. The blog receives a small commission at no additional cost to you. Thank you for your continued support. Credit Card issuers are not responsible for maintaining or monitoring the accuracy of information on this website. For full details, current product information, and Terms and Conditions, click the link included.

Credit Card Strategy – Introduction

You’ve set your travel goals! You know which airline frequent flyer programs will take you to your desired destination in a premium cabin and which hotels you can book with points without stretching your budget. With your Loyalty Program Strategy in place, it’s time to fund your newly opened airline and hotel loyalty program accounts!

There are different ways of accumulating points and miles. Yet, one of the fastest and most cost-effective ways is by signing up for the right credit cards. Many banks offer credit cards that come with attractive welcome offers as an incentive to sign up. This guide is the first in a series covering key elements and considerations to help you build an effective Credit Card Strategy as you pursue your travel aspirations.

In this post, we’ll begin by discussing your credit score. We’ll explore the factors that affect it and share effective strategies to improve and maintain a healthy score. Understanding this is key to improving your chances of credit card approvals.

Related Guides:

Loyalty Program Strategy for Beginners – Part 1

Loyalty Program Strategy for Beginners – Part 2

Loyalty Program Strategy for Beginners – Part 3

Credit Card Strategy – What’s in a Credit Score?

The average Canadian typically holds only one or two credit cards. Many are hesitant to apply for more to take advantage of lucrative welcome offers. Often, this reluctance stems from concerns about the potential negative impact on their credit score. This is a fair concern. After all, your credit score plays a major role in how financial institutions evaluate your ability to handle credit.

Understanding the factors that impact your credit score is essential for effectively managing it. So, what influences your credit score? The key ones include:

- Payment history: whether you pay your bills on time.

- Credit utilization: how much available credit are you using?

- Length of credit history: the age of your credit card accounts.

- Recent credit inquiries and new accounts: how many new accounts have you opened recently?

Image Credit: Rogatnev

Credit Card Strategy – Where to Find Your Credit Score?

Your credit score is calculated by two major credit bureaus: Equifax and TransUnion. They also track your credit history. You can access your credit score and report by paying for it directly from these bureaus. However, they sometimes offer trial periods for free. Alternatively, you can use free services like Borrowell (for Equifax) or Credit Karma (for TransUnion) to view your credit score and history online.

Your credit report provides a comprehensive summary of your credit history, detailing all accounts where lenders have extended credit to you. Before applying for credit cards, it’s a good idea to review your credit report and check it regularly.

Reviewing your credit report allows you to:

- Determine if you need to take action to improve your credit score.

- Verify that the information reported is accurate so that you can correct any errors found

- Detect early signs of identity theft

Credit Card Strategy – Managing Your Credit Score

Maintaining a healthy credit score is absolutely achievable. This is so even if you hold multiple credit cards. Here are some key strategies to effectively manage your credit score and enhance your chances of credit card approval:

- Stay on Top of Your Payments

Your payment history is one of the most important elements affecting your credit score. Always pay your credit card bills by due date. If you don’t, especially if you don’t at least make the minimum payment on time, it will significantly drop your credit score.

Paying your credit card bill in full each month is also key to avoiding punitive interest charges that can quickly outweigh any rewards or incentives that come with signing up for the travel rewards credit card. If you forget and pay your bill a few days late, don’t panic. You can give your bank a call, and they usually waive the interest charges. This is provided it’s a rare occurrence, and you have a solid payment history with them.

Many banks offer e-mail alerts you can sign up for to remind you of upcoming payment due dates on your cards.

Image Credit: Amex Canada

- Maintain a Credit Utilization Below 30%

Credit cards come with a monthly pre-set credit limit, unless they’re charge cards. As you put spend on the card, especially when trying to meet the Minimum Spend Requirement (MSR), keep an eye on your credit limit. It’s best to keep your usage below 30% of that limit to maintain a good credit score. If your credit limit is low, consider making payments throughout the month to keep your utilization low.

Another option is to transfer part of the credit limit from another card you have with the same credit issuer. This can help you manage your spending in the new card as you work to meet the MSR. A low credit utilization rate contributes to having a good credit score. Banks are less likely to view you as risky when your debt-to-credit ratio is low.

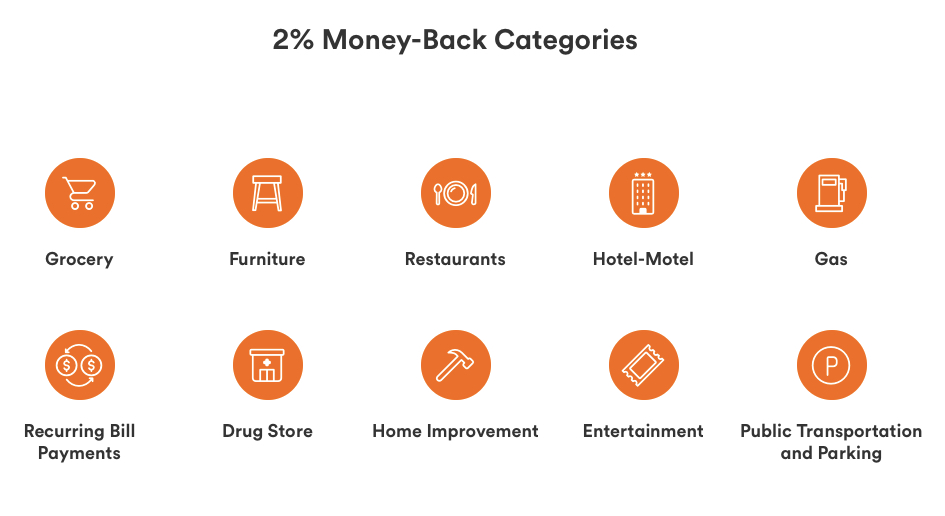

- Keep Your Oldest Card Open and Active

In the Loyalty Program Strategy, Part 2 – we covered the incredible value of flexible or transferrable points for booking award flights in business or even First class. You may be tempted to cancel your simple 2% cashback credit card and switch to a card that earns these powerful points. Before you do, consider the credit history you’ve built with your cashback card. If it’s your oldest card, hang on to it and put occasional spend on it. This will help you maintain that long credit history, which positively impacts your credit score.

While signing up for cards that have attractive welcome offers can supercharge your points and miles balances, do consider other factors as well. One effective strategy is to sign up for a credit card with strong multipliers on spending and designate it as your keeper card. Many cards, like the American Express Cobalt credit card, offer generous multipliers for specific spending categories. With this keeper card in your wallet, you’re on your way to building a long credit history while amassing a powerful points currency!

While signing up for cards that have attractive welcome offers can supercharge your points and miles balances, do consider other factors as well. One effective strategy is to sign up for a credit card with strong multipliers on spending and designate it as your keeper card. Many cards, like the American Express Cobalt credit card, offer generous multipliers for specific spending categories. With this keeper card in your wallet, you’re on your way to building a long credit history while amassing a powerful points currency!

- Avoid Opening Too Many Cards at Once

It may seem counterintuitive to state that you should limit the number of credit card applications when this is one of the primary ways to generate and accumulate points. Remember, it’s a marathon, not a race. Great credit card offers come and go, so you don’t need to apply to every offer, regardless of how attractive it is.

Applying for too many cards in a short time can hurt your credit score and may lead to application rejections. Different credit card issuers also have varying rules regarding how often you can receive welcome offers. For instance, American Express implemented rules in their T&Cs to discourage applicants from applying to the same card repeatedly. Note that if you’ve already received the welcome offer previously for a particular card if you’re approved, you may not receive the welcome offer of points again.

Other issuers, like TD and Scotiabank, may prevent you from receiving a welcome offer if you’ve held the same card within the last 12 or 24 months. Additionally, some banks, like National Bank, are sensitive to the number of tradelines you have open, which can affect your approval chances. When it comes to how strictly a bank enforces its T&Cs, your mileage may vary!

- Leverage Product Switching

One strategy to benefit from credit card welcome offers while avoiding a credit hit is by leveraging product switching. Banks like RBC, CIBC and TD allow you to switch from one card to another. Often, they offer a welcome bonus as part of the switch. While the welcome offer may be less than what’s publicly advertised, it’s still a great way to earn points without a hard inquiry on your credit report.

In contrast, American Express doesn’t offer product switching. However, they sometimes have targeted offers that let you upgrade your card. For example, they may offer the option to upgrade from a Personal Gold to a Platinum card. If you’re a longtime American Express client, applying for another card may not result in a hard credit hit, meaning your credit score wouldn’t be affected. However, this isn’t guaranteed.

Credit Card Strategy – Takeaway

Credit cards are a powerful way to boost your loyalty program balances. However, it’s essential to use them responsibly to truly maximize their value and benefits. Before diving into this hobby, make sure you have healthy personal finances and a strong credit score. For more tips and resources on managing your credit score, be sure to check out the info from the Government of Canada.

Image Credit: Fortunebuilders

Featured Image Credit: bernie_photo, via iStock