Table of Contents

Points Miles and Bling (blog) contains referral or affiliate links. The blog receives a small commission at no additional cost to you. Thank you for your continued support. Credit Card issuers are not responsible for maintaining or monitoring the accuracy of information on this website. For full details, current product information, and Terms and Conditions, click the link included.

Introduction

American Express (Amex) Membership Rewards (MR) points are Canada’s most valuable rewards currency, offering flexibility for redemptions such as cash back, gift cards, and travel. In this third installment of our series on American Express Membership Rewards, we will explore different ways to redeem MR points and discuss strategies to optimize redemptions for accessing premium flight rewards and hotels.

American Express Membership Rewards – Part 1

American Express Membership Rewards – Part 2

Etihad A350 Business Class & Emirates First Class

American Express Membership Rewards – Redemption Options

In part one of PMB’s Amex MR series, we introduced the rewards program and the flexibility the points provide. In part two, we discussed strategies to maximize the MR earning potential. Now that the points are accumulated, the fun begins as we explore all the redemption options and analyze which ones provide a good value and which provide a poor value. Here are all the possible ways MR points can be redeemed:

- Cover it with Points

- Travel with Points

- Transfer Points

- Gift Cards with Points

- Merchandise with Points

- Pay with Points to Shop

- Donate with Points

American Express Membership Rewards – Cents Per Point (CPP)

You may have heard about Cents Per Point, or CPP for short. This is a way to measure the value of reward points earned through credit cards, loyalty programs, and other promotional offers. It represents the value of each point or mile when redeemed for goods, services, or travel. The higher the CPP, the higher the value of the redemption. Amex MR can be redeemed at a straight 1% cash back, so anything above a 1.0 CPP is a redemption worth considering, but ideally, it should be much higher.

American Express Membership Rewards – Cover it with Points

The most simplistic way to redeem MR points is by applying them toward charges on your statement.

The redemption rate is $10 for every 1,000 points redeemed as a statement credit. This is effectively a 1% cash-back return on spending (or 1.0 CPP), well below an ideal redemption value. If the objective is cash back, Canada has much better cards, such as the Scotia Momentum Visa Infinite card.

The redemption rate is $10 for every 1,000 points redeemed as a statement credit. This is effectively a 1% cash-back return on spending (or 1.0 CPP), well below an ideal redemption value. If the objective is cash back, Canada has much better cards, such as the Scotia Momentum Visa Infinite card.

American Express Membership Rewards – Travel with Points

Amex Canada offers multiple ways to “Travel with Points” as follows:

The Flexible Points option allows members to pay for flights, hotels, and car rentals with American Express® Travel using their points, the card, or a combination of both (points and cash). Unfortunately, the redemption rate here is once again 1.0 CPP, with the advantage of offering the ability to mix cash and points. Suffice it to say, this is not a recommended way to travel with points.

The Flexible Points option allows members to pay for flights, hotels, and car rentals with American Express® Travel using their points, the card, or a combination of both (points and cash). Unfortunately, the redemption rate here is once again 1.0 CPP, with the advantage of offering the ability to mix cash and points. Suffice it to say, this is not a recommended way to travel with points.

The Air Canada option is again a poor value proposition with a 1.0 CPP redemption rate. It is the same as Cover It with Points but is marketed differently.

American Express Membership Rewards – Fixed Points Travel Program

The Fixed Points Travel Program redemption option allows the redemption of a fixed number of MR points to book a flight in economy or business class up to a maximum dollar value.

Here is the pricing for the Fixed Points Travel program:

Amex Fixed Point Travel Program (Economy Class)

Amex Fixed Point Travel Program (Business Class)

This redemption schedule provides a value over 1.0 CPP but will never exceed 2.0 CPP. The fixed points travel program allows booking any airline, flying anywhere, and travelling any day, as you are not restricted to award availability.

However, it’s important to note that the points will only cover the base cost of the ticket, not the taxes and carrier-imposed/fuel surcharges. In addition, only round trips departing from Canada are permitted, and you must have enough points to cover the cost (cash and points are not possible). Lastly, the tickets issued are regular cash tickets, and they may be basic fares that will not only qualify for earning miles but also may not cover seat assignments, baggage, etc.

American Express Membership Rewards – Transfer Points (Airlines)

Amex Canada can transfer MR points to 6 airlines and 2 hotel loyalty programs. Transferring points to these programs is the conduit to unlocking premium travel rewards! Let’s take a look at the airline loyalty programs first:

Amex Canada Airline Transfer Partners

The transfer ratios vary depending on the loyalty program being transferred to. However, all of them are excellent, with the poorest being Etihad Guest and Delta SkyMiles. Etihad Guest has a very restrictive cancellation policy, and finding Dellta flights priced fairly is like finding a needle in a haystack. As we review the others in more detail, pay attention to the CPP value compared to all of the other Amex MR redemption options discussed in this blog post.

Air Canada (Aeroplan)

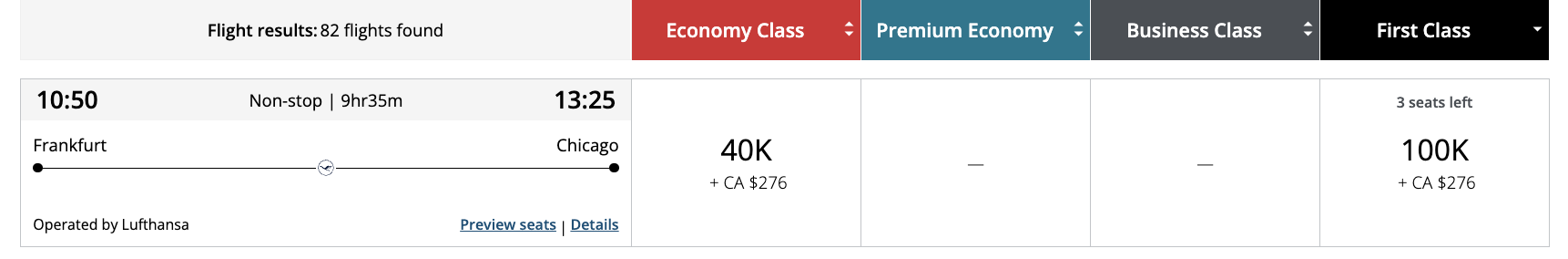

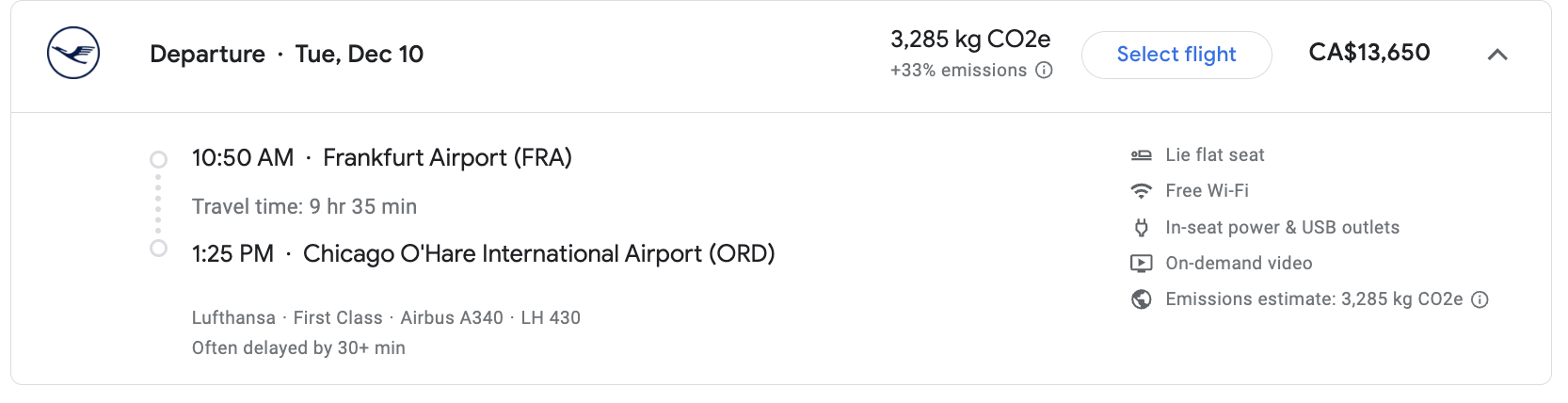

Air Canada Aeroplan is the best option for most American Express members because it provides access to 48 partner airlines, ensuring that some awards are always available to book. Although the program has drawbacks, such as high dynamic pricing on specific awards, it also offers fixed-cost redemptions on all partner airlines except Emirates—for example, a Lufthansa First Class flight. From Frankfurt to Chicago, costing $13,650, you can book just 100K points and a 13.37 CPP redemption!

Lufthansa First Class 747-8

British Airways Executive Club (Avios)

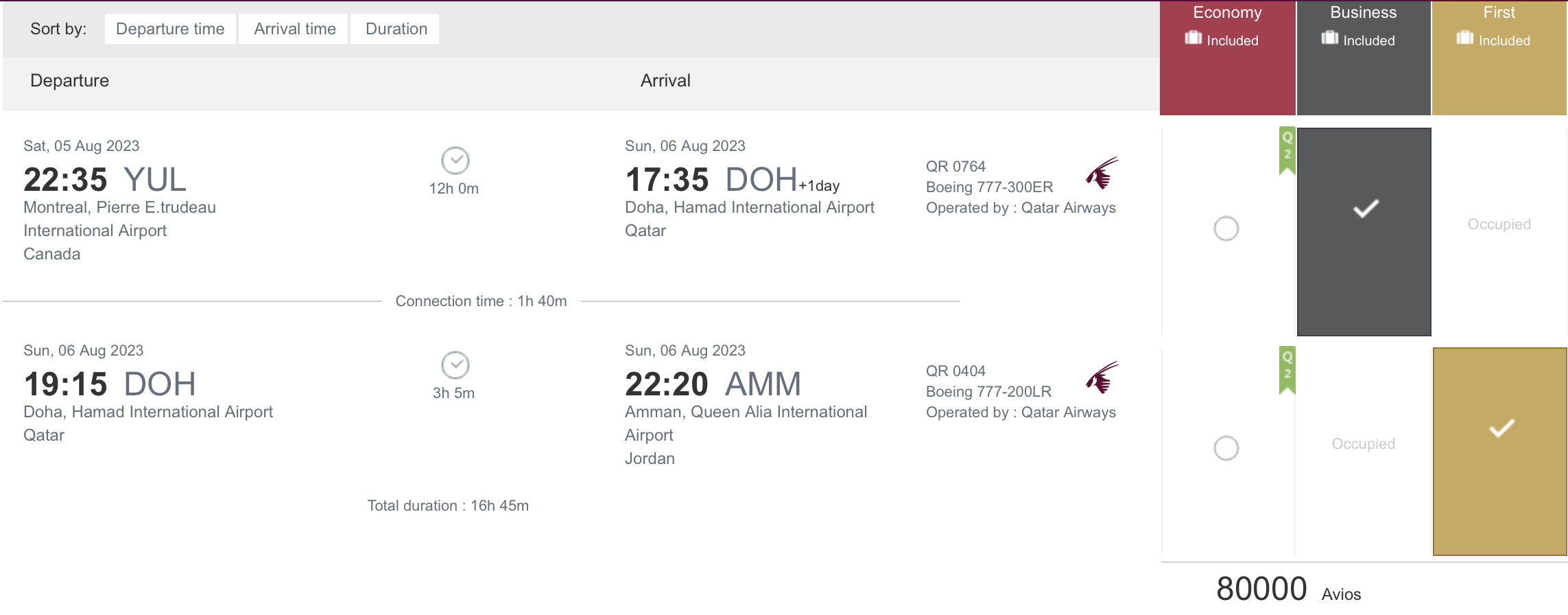

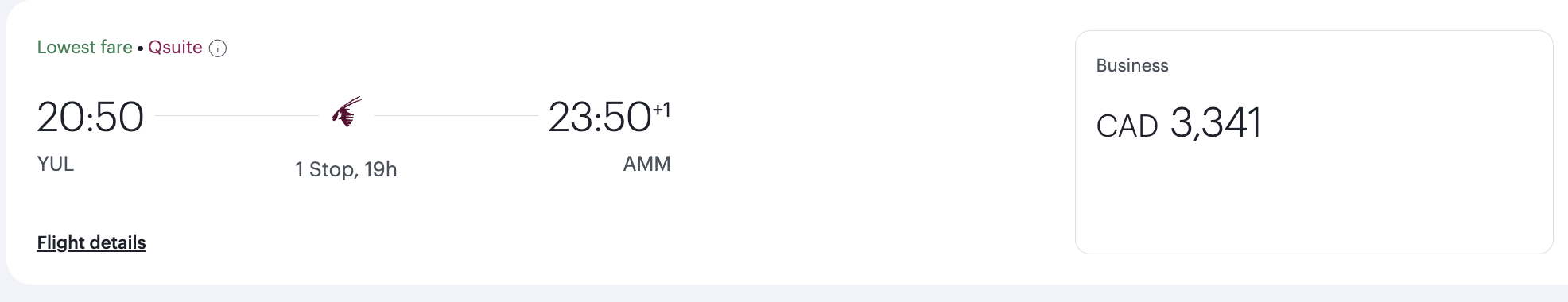

British Airways Executive Club is also a top transfer option with transfer bonus offers that come from time to time up to 30%, helping to gain access to the coveted Qatar Business Class Qsuite faster using their Avios points program. These Avios points can then be transferred to Qatar Privilege Club, Aer Lingus, and Iberia; each program offers redemption sweet spots.

Let’s analyze the CPP for a Qatar Qsuite flight that costs just 80,000 Qatar Avios points plus $420. This same flight costs $3341 with cash. Comparing the cash versus points, we can calculate a redemption value of 3.66 CPP, which is quite decent for a flight redemption. If points were transferred during a 30% transfer promo, the CPP shoots up to 4.75, which is very good!

Flight Booking through Qatar Privilege Club using Avios

The Qatar Qsuite (777)

Air France KLM (Flying Blue)

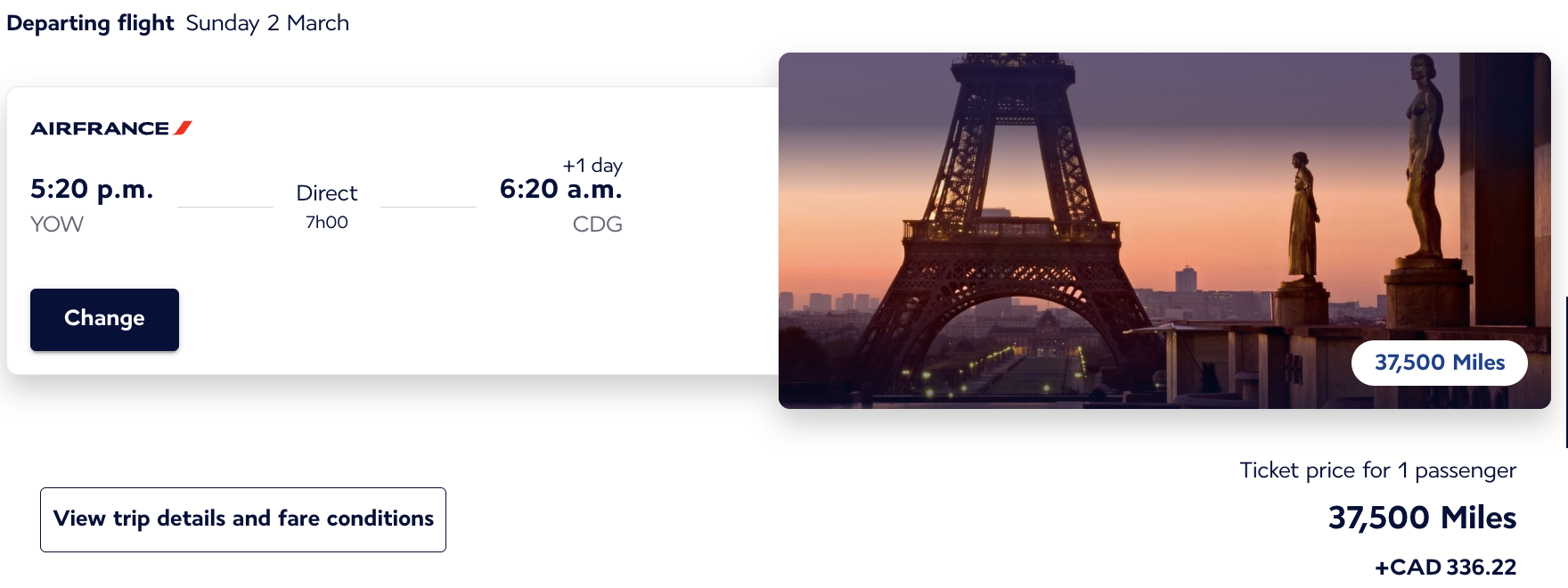

The Flying Blue program is an underrated loyalty program that offers access to more award seats than other programs at competitive prices for many markets, like flights between North America and Europe. Although the transfer ratio from Amex MR to Flying Blue is 1 to 0.75, it can still be worth it. Amex may also offer transfer promos to Flying Blue from time to time. Flying Blue also offers regular promo awards that can lower transatlantic flight costs to just 37,500 points (50,000 Amex MR) plus $336 in taxes.

Air France Business Class Promo Award

The cash equivalent of this flight would be $5725! Doing the calculation, this is a high 10.78 CPP redemption! Add an Amex to the Flying Blue transfer promo, and the CPP will improve even.

Air France New Business Class Seat, source: Air France

Cathay Pacific (Asia Miles)

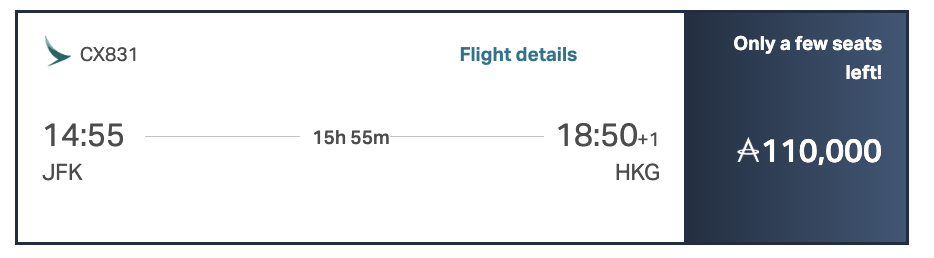

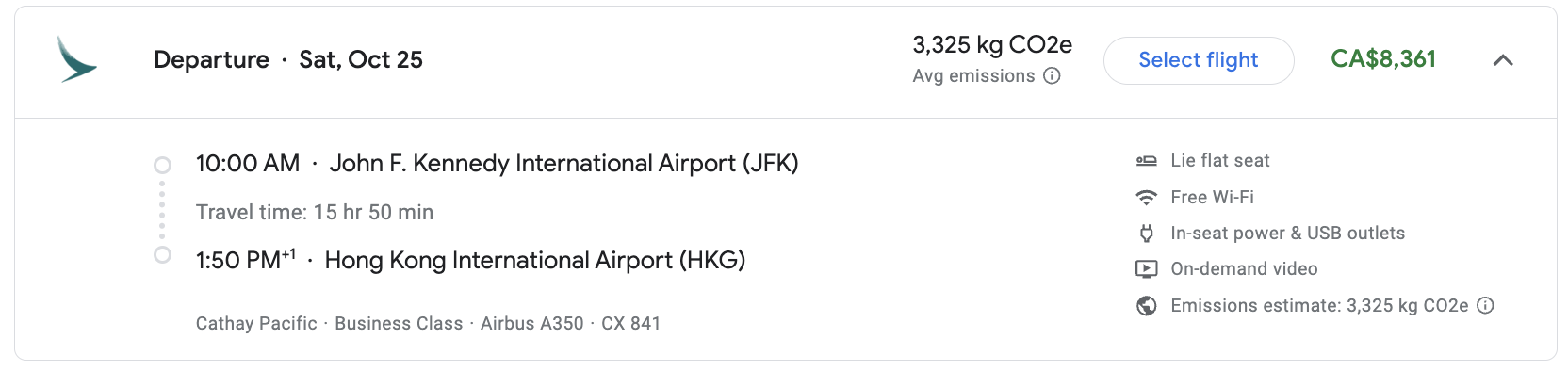

Like Flying Blue, Amex MR transfers to Cathay Pacific Asia Miles at a 1 to 0.75 ratio. It unlocks the ability to find more award seats on Cathay Pacific flights than through partner loyalty programs. Both Cathay Pacific’s business class and first class are excellent products. For example, a flight from New York JFK to Hong Kong would cost 110,000 Asia Miles (i.e. 146,667 Amex MR) plus $176 in taxes.

With the cash price for this flight costing $8361, the redemption value here is 5.58 CPP, which is quite good.

With the cash price for this flight costing $8361, the redemption value here is 5.58 CPP, which is quite good.

Cathay Pacific Business Class

American Express Membership Rewards – Transfer Points (Hotels)

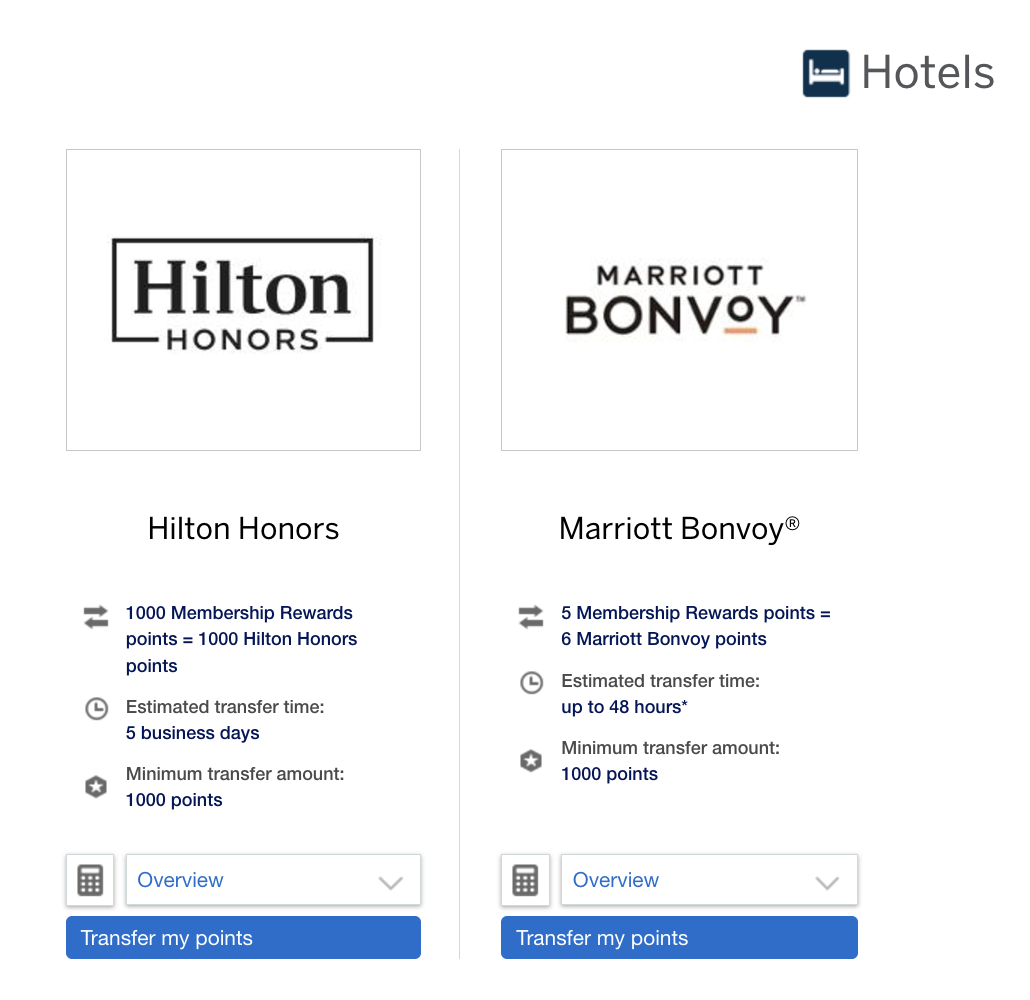

The 2 hotel loyalty programs that Amex MR can be transferred to our Hilton Honors and Marriott Bonvoy:

While Hilton has a simple 1:1 conversion ratio, Marriott is quirky with a 1:1.2 ratio. While on the surface, 1.2 may appear to be a better deal, the Marriott brand of hotels tends to be priced higher than their Hilton equivalent counterparts. Not only this, but Marriott’s footprint is much larger than that of Hilton. The programs have more pros and cons; it is important to understand them to help determine the right program for you, or perhaps both.

Hilton Honors

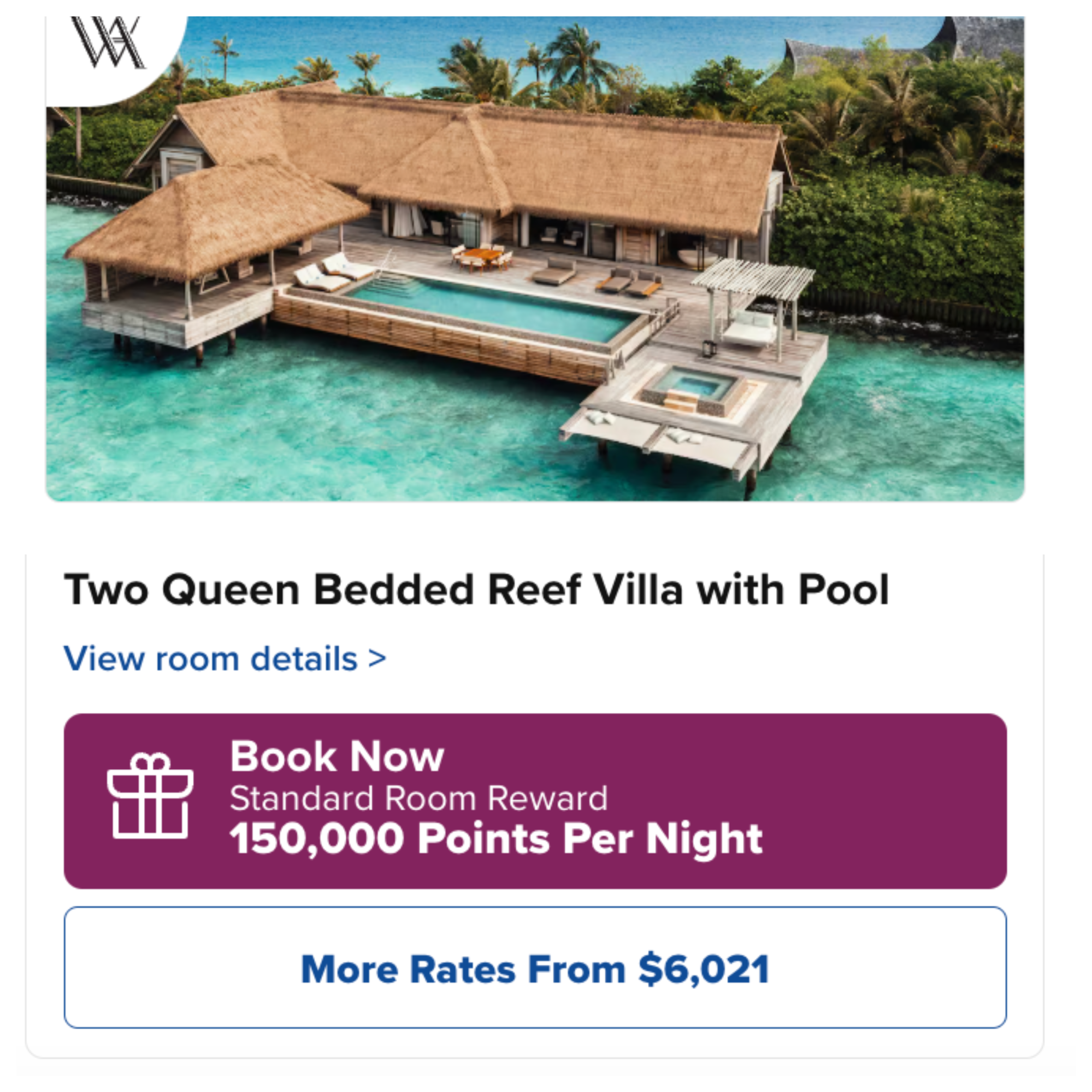

There is one simple reason why transferring to Hilton is not recommended: it is because the points can be purchased at 0.5 CPP (a 50% off promo that tends to be ongoing seemingly), which is a much better value. For example, look at redemptions at the Waldorf Astoria in Maldives that cost $6021/night or 150,000 points.

A simple calculation shows that transferring 150,000 Amex Membership Rewards (MR) points yields an excellent value of 4.01 CPP redemptions. This is comparable to flight redemptions. So, why not transfer them?

Well, you can purchase 150,000 Hilton Honors points for just $750. Wouldn’t you prefer to use those 150,000 Amex MR points for a couple of business-class or first-class flights instead?

If we consider the average premium flight redemption value to be 5.0 CPP, the opportunity cost of redeeming 150,000 Amex MR points is $7,500, minus the $750 cost to buy the Hilton points. This means you would effectively be redeeming at a -0.49 CPP! In other words, you’d be better off spending $6,021 per night on a hotel stay than converting your hard-earned Amex MR points to Hilton Honors points.

Marriott Bonvoy

Amex MR transfers at a 1:1.2 ratio to Marriott Bonvoy and can often be a good conversion. Marriot has an extensive portfolio of over 8,900+ properties to choose from to stay at. In contrast to Hilton Honors, purchasing Bonvoy points can be pretty expensive, typically costing between 0.73 and 0.89 CPP during promotional periods. While extracting greater value from buying points is possible, transferring points from Amex MR can also be advantageous, especially during regular 30% transfer promotions throughout the year. This promotion effectively raises the transfer ratio from 1 to 1.56, which is excellent!

Let’s have a look at the St. Regis Maldives costing 142,000 Bonvoy per night or 91,025 Amex MR (at 1:1.56 conversion):

With a cash rate of $2,185/night, the redemption option gives a 2.40 CPP value, which is very good. Maldives isn’t just an extreme example; many properties can easily provide redemption values over 1.8 CPP, which is my target when deciding between points and cash.

For simplicity, I did not do a USD <> CAD conversion; otherwise, the CPP would be much more significant.

In Summary: consider transferring to Marriott Bonvoy during transfer promotions, but avoid transferring to Hilton Honors.

American Express Membership Rewards – Gift Cards with Points

Amex MR can be redeemed for many types of gift cards right directly from their gift card store. However, just like cash back, the value for doing so is inferior: 0.77 to 0.8 CPP. You are better off buying the gift card elsewhere, charging it to the card, and using Cover it with points to give you a 1 CPP instead.

Purchasing Gift Cards with Amex MR

American Express Membership Rewards – Cover it with Points

Amex Canada offers an extensive catalogue of merchandise that can be bought and paid for directly with Amex MR points.

Similar to gift cards, this again proves a terrible value. Take the iPhone 15 Plus (256 GB) that retails for $1737 (tax in); redeeming 255,200 Amex MR for this gives a 0.68 CPP value, which is quite horrendous. Needless to say, avoid buying merchandise with Amex MR.

American Express Membership Rewards – Pay with Points to Shop

Pay with points to shop allows members to redeem their Amex MR points at some brands’ checkout directly:

However, the redemption rate is 1,000 MR = $7, or a poor 0.7 CPP. It is very low and a redemption to avoid

American Express Membership Rewards – Donate with Points

Amex Canada has the choice for members to donate their Amex MR points to one of their participating charity partners at a 1 CPP value. This is equivalent to the value of Cover it with Points, and I would implore members to consider donating using their Amex MR rather than redeeming gift cards, merchandise, or shopping that give a very low redemption value.

Summary

American Express offers significant versatility and flexibility in earning and redeeming Membership Rewards, Canada’s most valuable rewards currency. Not only can Amex MR be redeemed for cash back and merchandise, but they can also be transferred to airline or hotel loyalty programs to maximize their value. We assessed this value by determining a redemption’s CPP and reviewed examples of both high and low-value travel redemptions. The key takeaway is to use MR as extensively as possible by transferring to an airline or hotel program and completing the necessary travel bookings through those channels.