Table of Contents

Points Miles and Bling (blog) contains referral or affiliate links. The blog receives a small commission at no additional cost to you. Thank you for your continued support. Credit Card issuers are not responsible for maintaining or monitoring the accuracy of information on this website. For full details, current product information, and Terms and Conditions, click the link included.

Avion Rewards is RBC’s in-house loyalty rewards program, where members can earn Avion points through RBC’s suite of credit cards and banking products. Avion points are an extremely flexible currency, allowing miles and points enthusiasts to redeem their Avion points in various ways, which we’ll explore below.

Avion Rewards Program

Avion Rewards currently offers three separate membership tiers to the program, as determined by the RBC products being used. Some key distinctions between the different tiers include the following:

- Avion Elite represents the highest tier level of Avion points and can be earned by holding any of RBC’s Avion-branded credit cards, which include the Avion Platinum Visa, Avion Visa Infinite, Avion Visa Infinite Privilege, and Avion Visa Business.

- Avion Premium is the middle tier level of Avion points, which are earned on the RBC Ion and RBC Ion+ credit cards, as well as a number of other RBC banking products, including everyday banking and wealth management accounts.

- Avion Select is the base tier level of Avion points. While the two higher tiers can only be earned by RBC customers, Avion Select points can be earned by anyone – even if they are not a customer of RBC – by signing up for free on the Avion Rewards site and leveraging cash back and bonus points deals at online retailers and partner retail outlets.

While there are several nuances between the three tiers of Avion points, the most noteworthy are:

- Avion Elite points are considered the most versatile and valuable tier of Avion points because, unlike the other tiers, these can transferred to RBC’s airline partners and redeemed for RBC’s fixed Air Travel Redemption Schedule and other travel expenses (more on these below).

- Avion Premium points are more restrictive than elite points. Notably, they cannot be transferred to any of Avion’s airline partners except for Westjet, nor can they be used for the fixed Air Travel Redemption Schedule. The ability to redeem premium points for travel through RBC’s travel portal also results in a lower redemption value than the elite points. On the positive side, though, Avion Premium can easily be converted to Avion Elite points by holding any of RBC’s Avion credit cards and transferring points instantly between the different cards.

- Avion Select points, unfortunately, cannot be combined with Avion Elite or Avion Premium points, thereby severely capping their value.

As such, for the remainder of the article, we’ll focus on and reference Avion Elite points, acknowledging that Avion Premium points can be easily combined with Elite points.

How to Earn Avion Rewards Points

As you’d expect, the two most efficient ways to get Avion points will be from earning new card signup bonuses as well as from everyday credit card spends

Credit Card Signup Bonuses

Multiple times a year, we see RBC offer limited-time offers for the Avion Infinite and the Avion Infinite Privilege cards with elevated signup offers for new card applications. Earning the welcome offers on a brand new credit card is probably the best way to boost your points balances in the shortest period, and much more so if you can time an application strategically during an elevated offer.

While applying for one of the Avion cards will provide a healthy signup offer, the same cannot be said for the RBC Ion and Ion+ cards—however, what they lack in signup offers, they make up for in their points-earning structures.

Credit Card Spending

The second most efficient way of earning Avion miles is through day-to-day spending on your credit cards. The Avion suite of cards has a fairly standard rate of points earning, with mostly 1 Avion point earned per dollar spent on everything, with some exceptions, including the Avion Visa Infinite Privilege, Avion Visa Business, and travel purchases on the Avion Visa Infinite, which earn 1.25 Avion points per dollar spent.

The relatively newer Ion+ and Ion cards offer a more attractive earning structure at a lower annual fee, with the Ion+ notably earning an impressive 3 Avion points per dollar spent on popular categories such as grocery, dining, food delivery and gas. The addition of Ion cards to RBC’s lineup – along with the ability to convert the Avion Premium points earned on these cards to Avion Elite points – was a key reason for Avion becoming my defacto default currency in the past year for my everyday spend.

Avion Rewards Offers

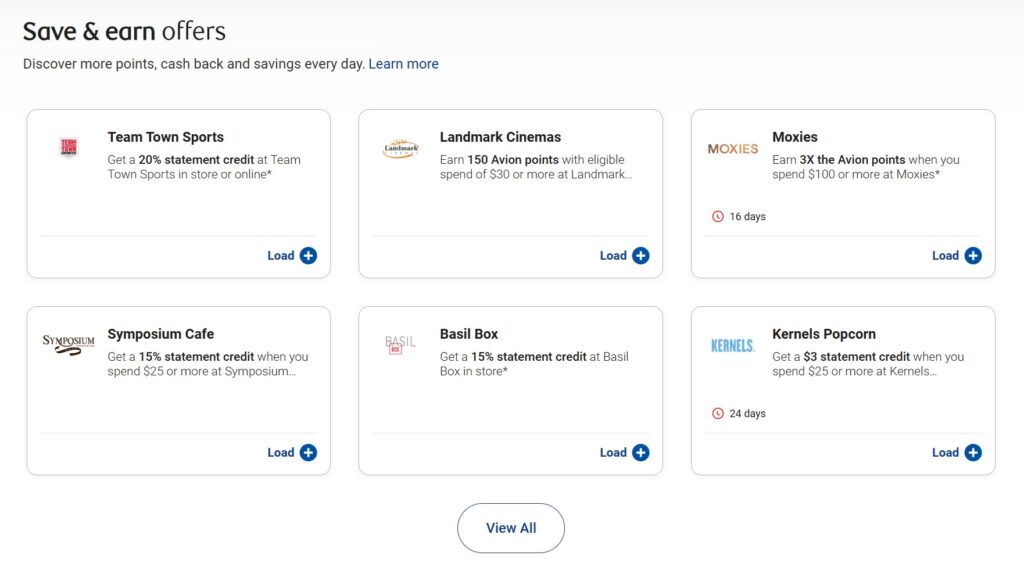

Another way to supplement your Avion points balance is through the “Offers” section on the Avion Rewards site, which allows members to earn bonus points with select retailers.

“Save & earn” offers must be activated and loaded onto the applicable cards before being used to pay at the corresponding retailer, similar to how the “American Express Offers” program works.

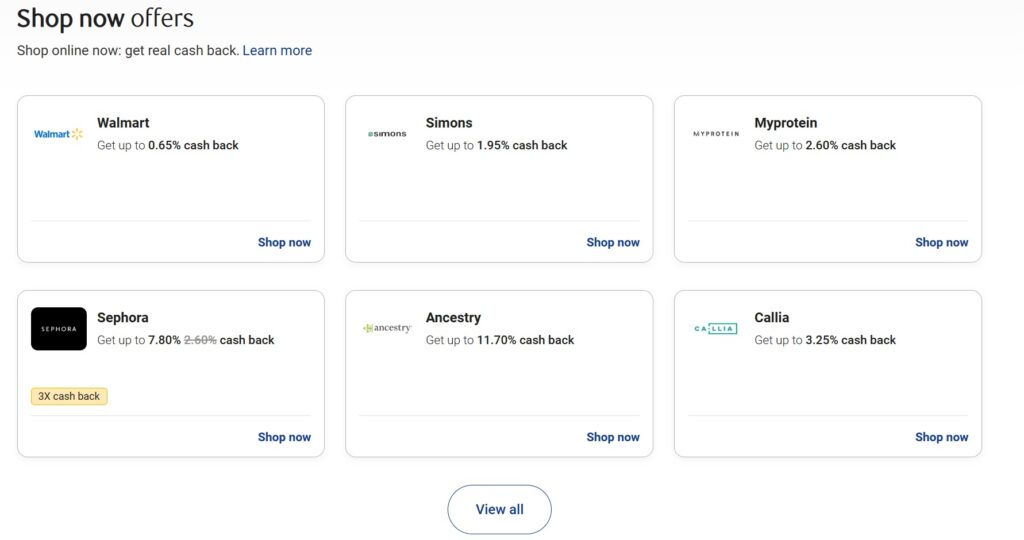

“Shop now” offers are more akin to traditional shopping portals like Rakuten or Aeroplan eStore, where you are required to click through a specific link to access a retailer’s website in order to unlock additional bonus points.

How to Redeem Avion Rewards

Transfer Partners

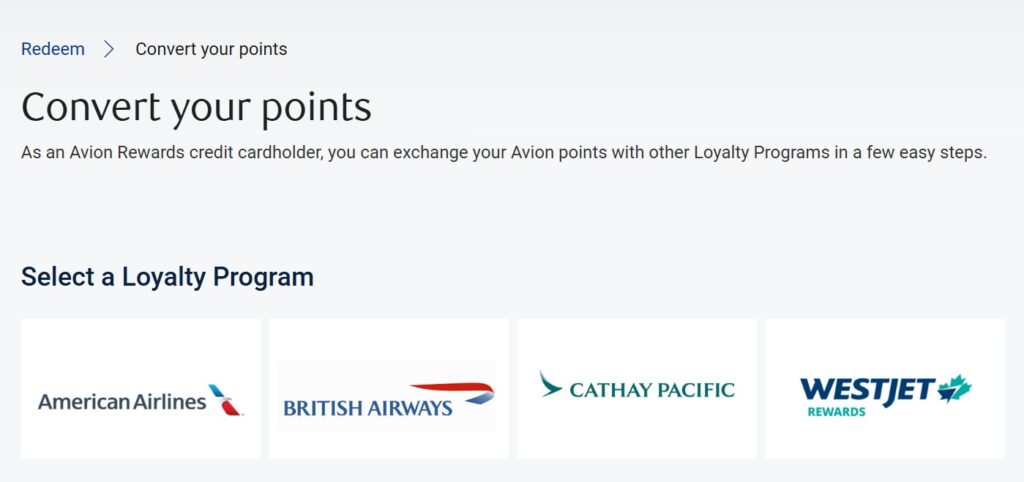

Amongst the most valuable uses of Avion points is the ability to transfer them to Airline partners. Currently, RBC’s airline partners include British Airways (1:1), Cathay Pacific (1:1), American Airlines (1:0.7) and Westjet (1:1).

While not having the amount of airline and hotel partners that the Amex Membership Rewards program has access to and putting Westjet aside, the other three partners can be instrumental depending on your travel patterns. Avion Rewards is also shockingly the only program on either side of the border that has a flexible currency that can transfer to the AA Advantage program (albeit at a less than 1:1 ratio – but nonetheless still very handy). Additionally, something else to keep in mind is that by transferring points into BA Avios, you can transfer to its other Avios partners like Aer Lingus, Iberia Airways, Qatar Airways and Finnair.

At least once a year, RBC offers a transfer bonus of ~30-40% to British Airways Avios, and occasionally, we have seen a transfer promotion to American Airlines as well, which brings the ratio closer to a 1:1 conversion.

Unlike most US transferable points currencies, transfers from RBC to airline partners are not instant, so it’s important to keep that in mind if considered a points transfers, as they are generally non-reversible.

Air Travel Redemption Schedule

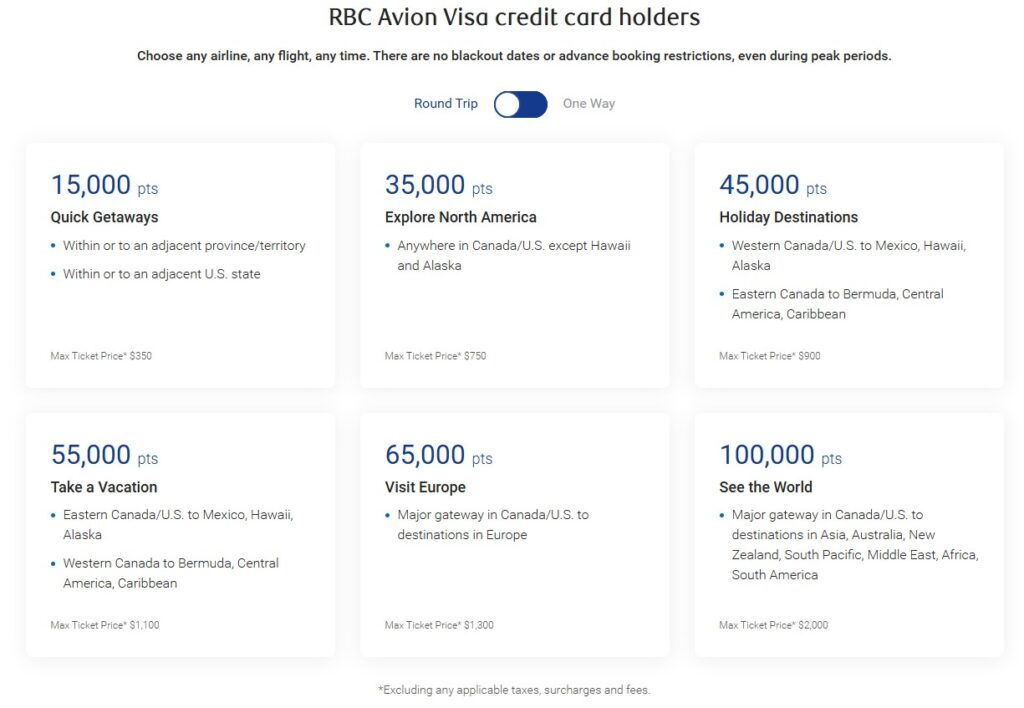

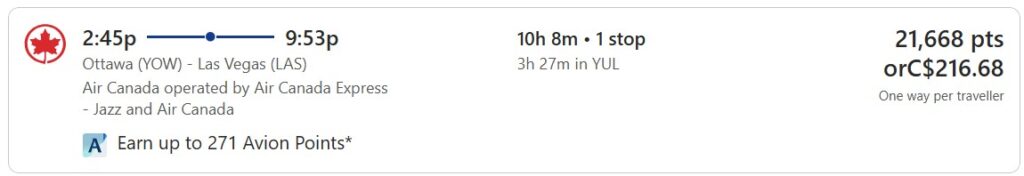

Another feature that Avion Rewards shares with Amex MR is the ability to redeem points based on a fixed redemption schedule for airline flights. The travel schedule outlines the amount of points required for tickets to six different regions and also defines the maximum cost of the ticket that the stated amount of points will cover off the base price of the ticket (taxes, surcharges, and fees are always extra).

While using Avion points for Travel Schedule redemptions might not yield as much value as transferring to an airline partner and redeeming points for a premium cabin, it is nevertheless a very good option in times when flight prices are on the higher end in both cash and points.

When you look at the chart a little closer, you’ll notice that the maximum value that can be derived is 2.3 cents per point when using it for the shortest segment (Quick Getaways), where 15,000 Avion points can theoretically cover $350 worth of the base fare.

Now, the reality is that you rarely find a ticket for sale where the base price is the exact upper limit. Furthermore, the points charged will not be reduced if the ticket base price is less than the maximum ticket price for that category, so it is possible, in situations where the base ticket is significantly discounted, to perhaps consider an alternative method for purchasing it (i.e., redeem Avion for statement credit, as discussed next).

Finally, in my experience, when booking through the Travel Schedule on a non-Air Canada/Westjet flight, you’ll always receive full credit for the flight with the corresponding loyalty program. It gets a little bit more uncertain if booking Air Canada and Westjet flights as often the fares booked are special bulk fares that RBC’s travel provider has presumably negotiated with the airlines beforehand and thus are ineligible for miles accrual. If the flight is crucial for requalification to a certain status level, then it might be best to consider using the Avion points to redeem for statement credit.

Statement Credit for Travel Purchases

Another popular and simple redemption option for Avion points is to use 1 Avion point for 1-cent statement credit towards travel purchases made through RBC’s travel portal. This fixed-value redemption even covers taxes, fees, and surcharges. RBC’s travel portal provider is Expedia, and I’ve never found a discrepancy between prices on RBC’s portal and other websites.

The process of redeeming is similar to redeeming TD Rewards points via its travel portal (also powered by Expedia), in which you simply select your travel options and can apply your desired number of points at checkout to offset your final cost.

Avion Visa Infinite Privilege and Visa Avion Business Statement Credit for Premium Cabins

My favorite use of Avion points is to redeem them for a statement credit – specifically for premium cabin revenue fares. The catch, however, is that applying points for a premium cabin flight ticket while holding an Avion Visa Infinite Privilege or Avion Business Visa allows you to double the value of your Avion points and redeem each Avion point for 2 cents vs. 1 cent for the standard statement credit option.

On many occasions, I have coupled this redemption option with a business class fare sale to score fantastic deals that also go a long way in either securing elite status, earning a significant number of miles, or giving me flexibility on flight dates when there were simply no points options.

Other uses

As you’d expect, the Avion Rewards program provides many other redemption options, such as redeeming points for gift cards, merchandise, non-travel statement credit, paying towards a credit card balance, and even deposits into investment accounts. However, in the vast majority of these scenarios, the redemption rate on 1 Avion point is well below 1 cent value which I consider the baseline for my points, thus making these other redemptions far from optimal options.

Final Word

I had been sleeping on the Avion Rewards program since I started this hobby. Over time, in the early 2020s, I began to see the value of collecting Avion points as a secondary currency. That view, however, significantly shifted with the introduction of the Ion+ card. Nowadays, the Ion+ plays a crucial role in my everyday spending strategy as the usual 3x points earned on dining, groceries, and gas essentially translates to a 6% return when I am using Avion points for a 2 cent per point redemption for premium flight cabin – an incredible return for a very low annual fee credit card.

My other favorite use continues to be transferring to British Airways Avios and American Airlines—especially when either of them is running a transfer promo. These currencies allow me to book redemptions on Qatar Airways for my frequent travels back home to the UAE and Pakistan.

So, if you haven’t stepped into the RBC eco-system yet – I highly encourage you to look into it, as it has now become a crucial part of my Canadian points strategy.

Featured Image Credit: RBC