Points Miles and Bling (blog) contains referral or affiliate links. The blog receives a small commission at no additional cost to you. Thank you for your continued support. Credit Card issuers are not responsible for maintaining or monitoring the accuracy of information on this website. For full details, current product information, and Terms and Conditions, click the link included.

Since the onset of the pandemic in March 2020, we have seen many initiatives by the tourism industry to breathe some life back into the industry. Even credit card companies in Canada promoted local travel by offering credits to registered cardmembers. Now the Ontario government has announced a new temporary tax credit (passed as law) for 2022, Ontario Staycation Tax Credit, a refundable credit of up to $400 for Ontario residents.

Ontario Staycation Tax Credit

The tax credit is a government initiative to help the tourism industry recover, by encouraging the residents to explore their home province, ON. Residents can get a maximum credit of $200 (individual) or $400 (for a family), when they spend $1000 or $2000 respectively, in accommodation expenses in Ontario. Ontario government describes this tax credit as following;

This Personal Income Tax (PIT) credit would provide Ontario residents with support of 20 per cent of eligible 2022 accommodation expenses of up to $1,000 for an individual and $2,000 for a family, for a maximum credit of $200 or $400, respectively.

Ontario residents could apply for this refundable credit when they file their 2022 taxes. Eligible accommodation expenses are as following;

For a stay of less than a month at an eligible accommodation such as a hotel, motel, resort, lodge, bed-and-breakfast establishment, cottage or campground in Ontario;

For a stay between January 1 and December 31 of 2022;

Incurred for leisure (e.g., a non-business purpose);

Paid by the Ontario tax filer, their spouse or common-law partner, or their eligible child, as set out on a detailed receipt;

Not reimbursed to the tax filer, their spouse or common-law partner, or their eligible child, by any person, including by a friend or an employer; and

Subject to Goods and Services Tax (GST)/Harmonized Sales Tax (HST), as set out on a detailed receipt.

You can read the details of the Ontario Staycation Tax credit here.

Maximizing discount on Ontario Stays

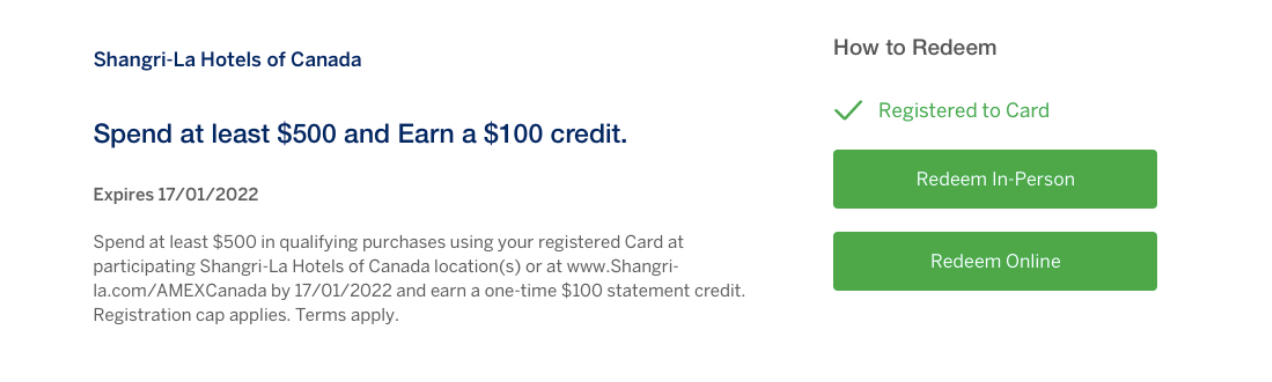

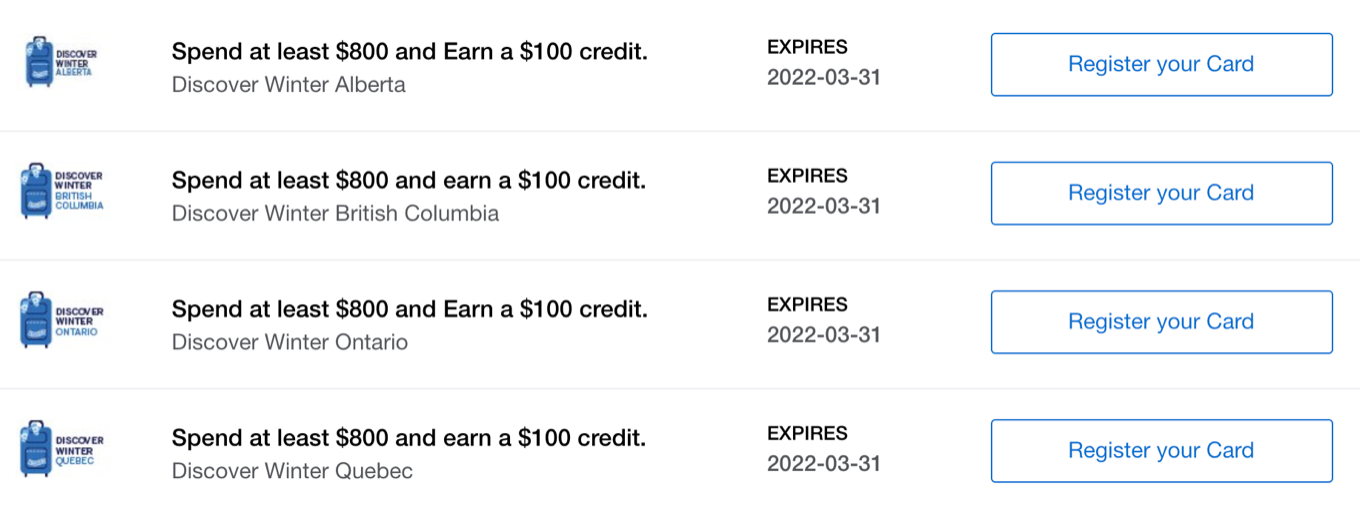

For readers of this blog (that are ON residents), the tax credit can be seen as an additional discount to your upcoming hotel stays in Ontario. Here is how I am thinking about this – I have been waiting to experience the Shangri-La hotel in Toronto ever since the following Amex credits were announced;

Putting the two together, a $1000 stay at the Shangri-La can be subsidized by at least $400 ($200 Amex offers + $200 Staycation Tax Credit), a sweet 40% discount!

Not sure how effective the new tax credit will be in convincing Ontario residents to make new plans to make use of the credit, but for those of us that already had plans, the tax credit is welcome news. If you are planning to leverage this credit for an upcoming stay, do share in comment below. Wishing you all a very Happy New Year – cheers!

3 comments

[…] This was published on BoardingArea, to read the complete content please visit https://travelupdate.com/ontario-staycation-tax-credit-up-to-400-for-ontario-families/. […]

Pandemic aside, why not bring back the GST/PST/HST refunds for international visitors?

I dont think thats going to be brought back. We need those taxes to fund local destinations. Also, I dont think folks visit Canada as a shopping destination to behin with, so that was an easy claw back in 2007.