Table of Contents

Scotiabank – An introduction

Scotiabank continues to be a trusted partner for millions of Canadian households, offering a wide range of banking and financial services. Among the many services, their credit cards stand out for flexibility, rewards, and tailored benefits. Whether you’re a frequent traveller, a cashback enthusiast, or enjoy dining out and entertainment, Scotiabank has a credit card to suit your lifestyle. A key feature of many Scotiabank credit cards is the Scene+ points program. This innovative loyalty program allows cardholders to earn points on everyday purchases, which can be redeemed for various rewards. Scene+ points can be used for travel, entertainment, dining, and even at partner retailers. The program’s flexibility and wide range of redemption options make it a popular choice for those looking to maximize the value of their spending.

Scotiabank Gold American Express Card – Apply Now

- Annual Fee:

$120First Year Annual Fee Waived‡ - Welcome Bonus: Up to 50,000 bonus Scene+ points† (Apply by October 31, 2025)

- 30,000 points with $2,000 in everyday eligible purchases in the first 3 months from account opening

- 20,000 points with $7,500 in everyday eligible purchases in the first year of Cardmembership

- Earning Rate:

- 6X at Sobeys, Safeway, FreshCo, Foodland, and more*

- 5X on other Grocery stores, Dining and Entertainment (Canada only)*

- 3X Gas, Daily Transit, Select Streaming Services (Canada only)*

- 1X on all other purchases

- Other Key Benefits:

- Pay no foreign transaction Fees¹ – save 2.5% on all your foreign currency purchases

- Additional benefits + 4X on every dollar spent on hotel bookings, car rentals and on things to do with Scene+ Travel, Powered by Expedia

- Comprehensive Travel and shopping Insurance coverage*;

- Travel Medical Emergency Insurance

- Trip Cancellation/Trip Interruption Insurance

- Flight Delay Insurance

- Delayed and Lost Baggage Insurance

- Travel Accident Insurance

- Rental Car Collision Loss/Damage Insurance

- Hotel/Motel Burglary Insurance

- Mobile Device Insurance

- Purchase Security & Extended Warranty Protection

A detailed list of benefits and perks of the Card is listed here

Scotiabank Passport® Visa Infinite* – Apply Now

Dubbed the best No Foreign Transaction fee card in Canada, this Visa card is fast becoming a travel favourite because of its worldwide acceptance. With complimentary lounge access and the ability to earn points on everyday spending, it’s easy to see why the Card enjoys the accolades it does.

-

- Annual Fee: $150

- Welcome Bonus: 40,000 bonus Scene+ points† (Apply by October 31, 2025);

- 35,000 points with at least $2,000 in everyday eligible purchases in the first 3 months.

- 10,000 points with at least $40,000 in everyday net eligible purchases annually.

- Earning Rate:

- 3x at Sobeys, Safeway, FreshCo, Foodland, and more*

- 2x on other eligible grocery, dining, entertainment and daily transit purchases (including buses, subways, taxis and more)*

- 1x on all other purchases

- Other Key Benefits:

- Pay no foreign transaction Fees¹ – save 2.5% on all your foreign currency purchases

- Complimentary Priority Pass™ membership, plus six free visits per year from the date of enrollment

- Comprehensive Travel and Shopping Insurance coverage

A detailed list of benefits and perks of the Card is listed here

Scotiabank Passport Visa Infinite Business Card – Apply Now

The card is tailored for business owners seeking to maximize rewards and enjoy premium travel benefits. Cardholders earn 1.5 Scene+™ points for every $1 spent on eligible business purchases, with no foreign transaction fees on international purchases. The card also offers comprehensive travel insurance coverage and complimentary access to airport lounges through the Visa Airport Companion Program.

-

- Annual Fee: $199/Year

- Welcome Bonus: 40,000 bonus Scene+ points (Apply by October 31, 2025);

- 30,000 points with at least $5,000 in eligible business purchases in the first 3 months.

- 10,000 points with at least $60,000 in net eligible business purchases annually.

- Earning Rate: 1.5x for every $1 spent on business purchases

- Other Key Benefits:

- No Foreign Transaction Fees for purchases made online or outside Canada.

- Complimentary Airport Lounge Access, six free visits per year from the date of enrollment

- Complimentary Avis Preferred Plus membership

- Visa Infinite Benefits, including Visa Infinite Concierge and the Luxury Hotel Collection.

- Comprehensive Travel and Shopping Insurance coverage

A detailed list of benefits and perks of the Card is listed here

Scotiabank Platinum American Express Card – Apply Now

A premium travel credit card in the Scotia portfolio that offers an elevated 2x earn on all purchases (without restrictions), along with complimentary lounge access, no foreign transaction fees, and comprehensive travel insurance.

-

- Annual Fee:

- Primary Card: $399/year

- Supplementary Card: $99/year

- Welcome Bonus:

- 80,000 bonus Scene+ points (Apply by October 31, 2025);

- 60,000 bonus Scene+ points by making at least $3,000 in everyday eligible purchases in your first 3 months

- 20,000 Scene+ points bonus when you spend at least $10,000 in everyday eligible purchases in your first 14 months

- 80,000 bonus Scene+ points (Apply by October 31, 2025);

- Earning Rate:

- 2x Scene+ points for every $1 spent on ALL eligible purchases

- Other Key Benefits:

- No FX markup: Foreign Currency Conversion Fee of 0%

- Airport Lounge Access – Priority Pass™ and Plaza Premium lounges

- Primary cardholders get 10 free visits per year from the date of enrolment

- Supplementary cardholders get four free visits per year from the date of enrolment

- Comprehensive Travel and Shopping Insurance coverage

- Travel Emergency Medical Insurance

- Trip Cancellation / Trip Interruption Insurance

- Flight Delay Insurance

- Rental Car Collision Loss/Damage Insurance

- Delayed and Lost Baggage Insurance

- Travel Accident Insurance

- Hotel/Motel Burglary Insurance

- Mobile Device Insurance

- Purchase Security & Extended Warranty Protection

- Annual Fee:

A detailed list of benefits and perks of the Card is listed here

Redeeming Scene+ points

With Scene+, you can make travel arrangements with any travel provider, site, or operator you choose, and then select the “Apply Points to Travel” option to redeem points to cover your trip costs within 12 months from the date of the eligible travel purchase. Simply:

- Book eligible travel using your Scotiabank Passport Visa Infinite* Card

- Wait for your travel purchase to be posted to your Card

- Log into ScenePlus.ca, and redeem your Scene+ points towards the travel purchase (10,000 points = $100)

Or you can choose to redeem your Scene+™ for non-travel redemptions.

- Redeem for gift cards, prepaid cards or other merchandise.

- Redeem points at 700+ dining partners, including Swiss Chalet, Harvey’s, Montana’s and more.

- Points for Credit – Use the ‘Points for Credit’ option to receive a statement credit on your account.

Scotia Momentum Visa Infinite card – Apply Now

The Scotiabank Momentum Visa Infinite card is, hands down, the best cashback card in Canada. No annual fees and 10% cashback on all purchases (up to $2000 in purchases) for the first three months make this a must-have card for all households. After that, this card is a powerhouse for household expenses, with a 4% cashback on groceries, bill payments, and subscription payments and a 2% cashback on gas and daily transit.

-

- Annual Fee:

$120First Year Annual fee waived on Primary and Supplementary Cards - Welcome Bonus: 10% cash back on all purchases for the first 3 months (up to $2,000 in total purchases) (Apply by October 31, 2025)

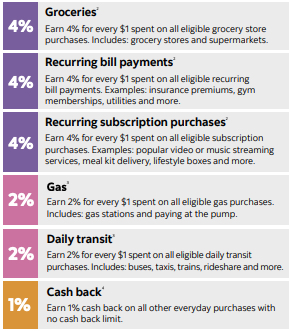

- Earning Rate:

- 4% on Groceries (incl. Supermarket), Recurring Bills, and Subscription payments ($25k annual limit)

- 2% on Gas, Daily Transit ($25k annual limit)

- 1% on all other eligible everyday purchases

- Annual Fee:

-

- Insurance Coverage:

- Travel Emergency medical coverage for persons under 65

- Trip Interruption

- Trip Cancellation

- Flight Delay

- Delayed or Lost Luggage

- Rental Car Collision/Lost Damage

- Extended Warranty

- Purchase Security

- Mobile Device Insurance

- Insurance Coverage:

Note: The Scotia Momentum Visa Infinite cashback program is an annual program. The amount earned under the Cash Back Bonus Rate is credited within 7 months from the account opening date. Regular Cash Back accumulates each month and is awarded at the end of each 12-month period directly (in November) into an Eligible Account or as a credit on the statement.

A detailed list of benefits and perks of the Card is listed here

Scotia Momentum® for business Visa* Card – Apply Now

The Card is designed to help businesses maximize their rewards and manage expenses effectively. Cardholders earn 3% cash back on eligible gas station, restaurant, and office supply store purchases, as well as on recurring bill payments, and 1% cash back on all other eligible business purchases.

-

- Annual Fee: $79

- Special Offer: 2.99% introductory interest rate on Balance transfers for the first 6 months

- Earning Rate:

- 3% on Gas Stations, Restaurants and Office Supply Stores

- 3% on Recurring Bill Payments

- 1% on all other eligible purchases for Business

- Other Key Benefits:

- 25-day interest-free grace period on new purchases

- Flexibility to buy now and pay over time with Scotia SelectPayTM

- Insurance Coverage:

- Travel Emergency Medical Coverage

- Rental Car Collision/Lost Damage

- Purchase Security & Extended Warranty Protection

Note: The Scotia Momentum Visa cashback program is an annual program. The amount earned under the Cash Back Bonus Rate is credited within 7 months from the account opening date. Regular Cash Back accumulates each month and is awarded at the end of each 12-month period directly (in November) into an Eligible Account or as a credit on the statement.

A detailed list of benefits and perks of the Card is listed here

________

Disclosures:

† With minimum spend in the 1st year. Conditions apply.

‡ Conditions Apply

¹ Exchange rate still applies. Conditions apply.

*On eligible purchases in Canada only. Conditions apply