Points Miles and Bling (blog) contains referral or affiliate links. The blog receives a small commission at no additional cost to you. Thank you for your continued support. Credit Card issuers are not responsible for maintaining or monitoring the accuracy of information on this website. For full details, current product information, and Terms and Conditions, click the link included.

As I sit watching the Mumbai Indians vs Royal Challengers Bengaluru match, it’s not just the sixes and wickets catching my eye — Qatar Airways is splashed across the Bengaluru kits. The crossover between cricket and travel is hard to miss, and nowhere is it more visible (or lucrative) than in the Indian Premier League (IPL). Let’s unpack how airlines and travel brands are riding the IPL wave — from mega sponsorships to growing footprints in the Indian market.

First, some context. The IPL is not just a cricket tournament; it’s a pop culture juggernaut. In 2023, the IPL racked up over 500 million viewers, with digital viewership breaking records on JioCinema. The league’s cultural relevance is off the charts, especially among urban, mobile-first audiences.

Advertisers love it — and they pay a premium. IPL title sponsorship deals and team sponsorship packages cost 12M+ for a major brand per season. The tournament’s broadcast and streaming rights for 2023–2027 were sold for a jaw-dropping $5.1B, putting the IPL just behind the NFL in terms of per-match value.

Airlines and tourism boards have taken note. Here’s how the current travel ecosystem looks on the IPL scoreboard:

- Qatar Airways is the official sponsor for Royal Challengers Bengaluru (RCB), with jersey branding and in-stadium visibility.

Credit: iplt20.com

- Etihad is the official sponsor for Chennai Super Kings (CSK). The partnership includes co-branded content and fan engagement campaigns.

Credit: iplt20.com

- Visit Saudi is a prominent sponsor for the IPL. It is not tied to a specific team but splashed across matchday visuals and ad slots. The deal is worth $7.2M per year.

Credit: IPL official account on X

-

Tata Group, the IPL’s title sponsor (2024-2028), owns Air India, which is now rebranding and expanding aggressively post-privatization. The title sponsorship was worth ~$300M.

- Curiously, Emirates does not directly sponsor any IPL team, although it has a long history with global cricket, including partnerships with the International Cricket Council (ICC) and other cricket boards.

Credit: Emirates – Official Sponsor of Cricket World Cup 2023

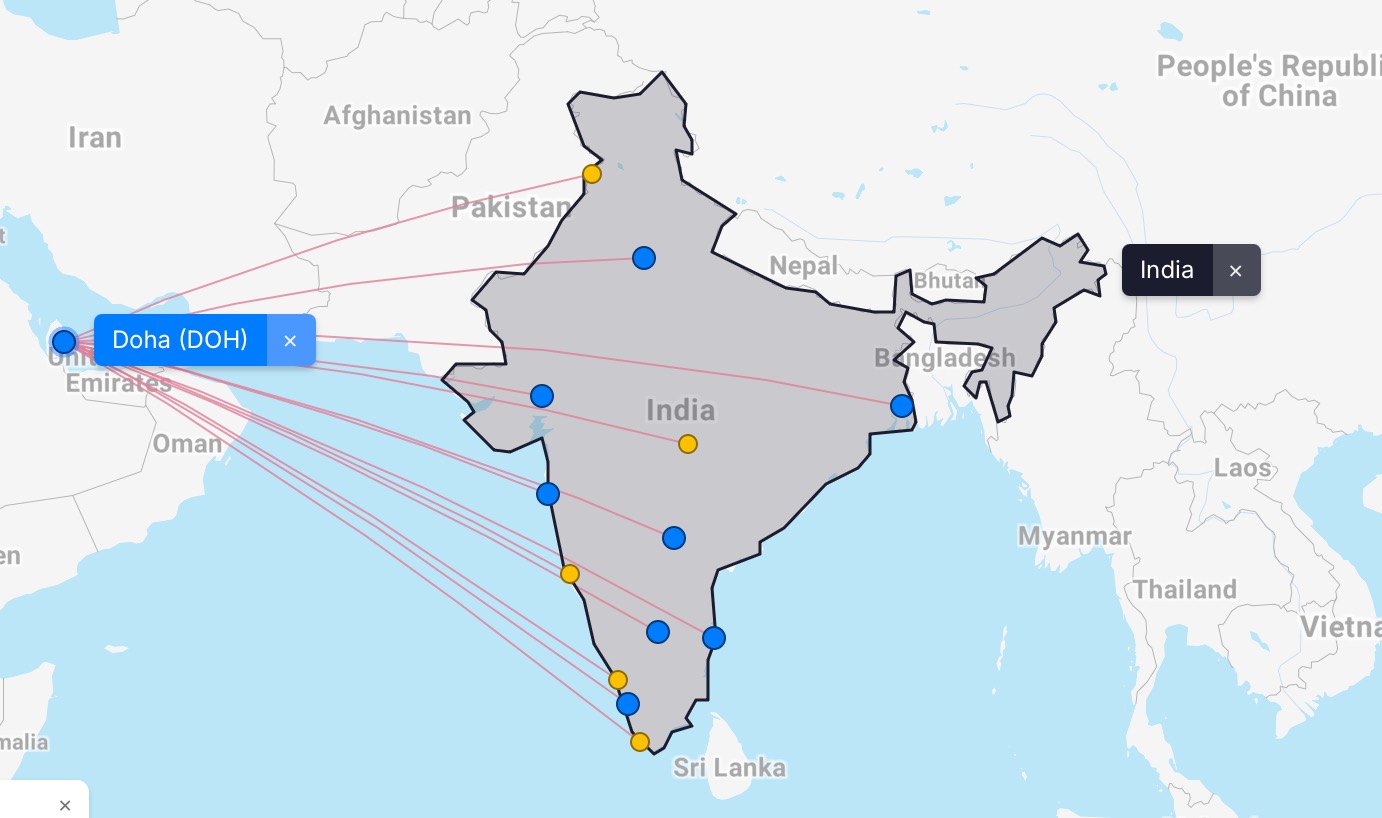

The current footprint of Middle East carriers in India for these airlines looks like this via FlightConnections;

- Qatar Airways flies to over 13 Indian cities, from metros to tier-2 hubs.

Airlines and IPL – Qatar

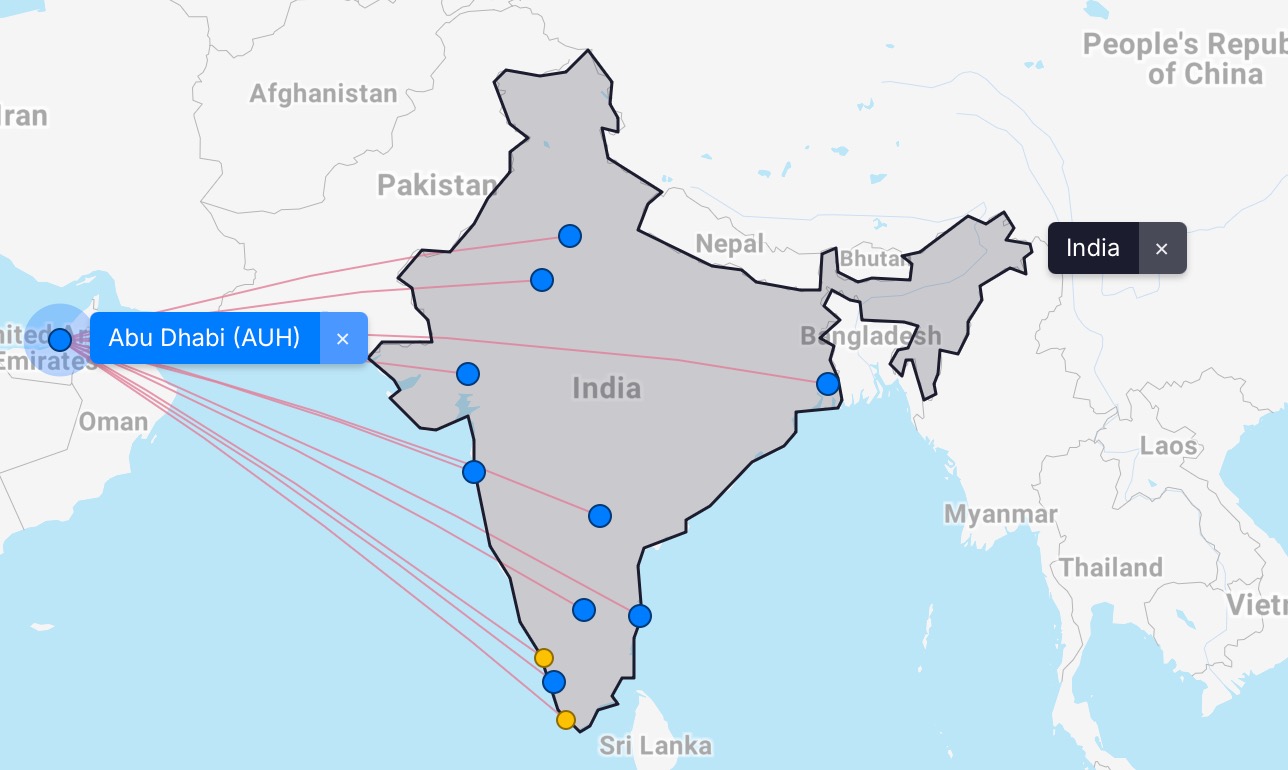

- Etihad connects 10 Indian destinations to its Abu Dhabi hub.

Airlines and IPL – Etihad

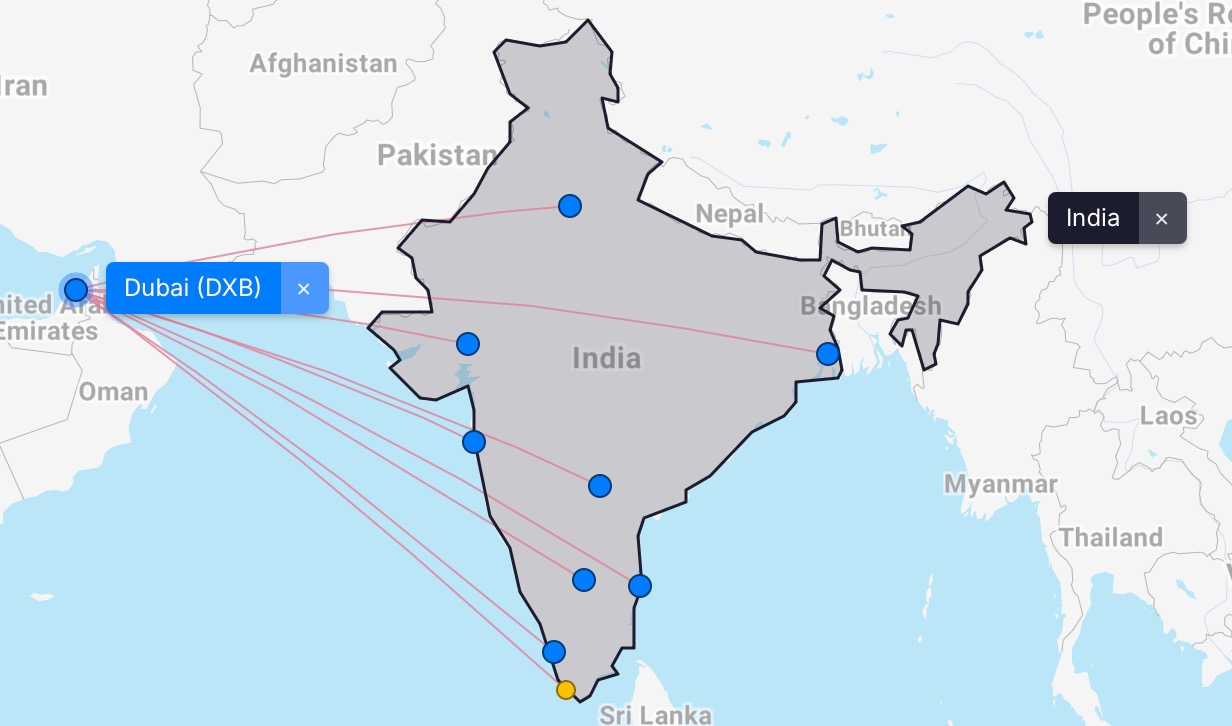

- Emirates flies to 9 Indian cities and operates 170+ flights weekly.

-

Airlines and IPL – Emirates

India’s Airline Slot Diplomacy: A Turbulent History

A deeper subplot here is the long-standing issue of bilateral air service agreements. Historically, India has restricted slots for Gulf carriers to protect its national carriers—Air India, Indigo Airlines, and Jet Airways (before they shut down). As a result, airlines like Emirates, Qatar, and Etihad have long wanted more frequencies and city pairings but were blocked or limited. India hesitates to ease restrictions as Indian airlines await close to 1000 new aircraft to join their fleet and as Air India continues its major overhaul. Easing restrictions before Indian airlines are settled and individually competitive could open the floodgates for more Middle East carrier capacity.

Middle East carriers are already punching above their weight in India, as UAE and Qatar are among the top outbound destinations for Indian flyers. These carriers act as hubs for long-haul travel, offering one—stop connections to Europe, Africa, and North America. Indian travelers are prime targets, especially those booking premium cabins and long-haul trips using points or cash.

Given this, IPL sponsorships are about much more than branding. For airlines, it’s a calculated bet. With India being one of the world’s fastest-growing aviation markets, visibility during IPL is about staking a claim in a high-growth corridor.

Airlines and IPL – Takeaway

Cricket may be India’s religion, but Middle East carriers are increasingly becoming part of the prayer. From stadium ads to team jerseys, airline and travel sponsors are betting on the IPL to connect with India’s billion-plus travelers of tomorrow. And as aviation diplomacy evolves, we will see more of these partnerships take off.