Table of Contents

Points Miles and Bling (blog) contains referral or affiliate links. The blog receives a small commission at no additional cost to you. Thank you for your continued support. Credit Card issuers are not responsible for maintaining or monitoring the accuracy of information on this website. For full details, current product information, and Terms and Conditions, click the link included.

Introduction

In this second part of the series on American Express (Amex) Membership Rewards (MR), we’ll explore the various types of cards that earn MR and discuss strategies for optimizing spending to unlock the maximum earning potential. We’ll also look at ways to capitalize on welcome offers and ensure all those credit card fees are worthwhile. By understanding these nuances, you’ll be better equipped to leverage Amex cards to enhance your travel experiences and maximize the value of your points and miles.

American Express Membership Rewards – Part 1

American Express Membership Rewards – Part 3

Amex MR points are Canada’s most valuable reward currency, and they have great flexibility when redeeming them for things like straight cash back, gift cards, and travel. Furthermore, transferring to airline and hotel partners unlocks further value by making those first and business-class flights a reality to dream destinations staying at luxurious five-star hotels.

American Express Membership Rewards – Card Types and Earn Rates

As introduced in American Express Membership Rewards – Part 1, Amex Canada offers a wide range of cards, including basic cash back, Aeroplan, Marriott Bonvoy, and a family of Membership Rewards cards. However, only six cards earn membership reward points, and here they are, along with their annual fees:

- American Express Gold Card – $250

- American Express Platinum Card – $799

- American Express Cobalt Card – $12.99/month

- American Express Green Card – no annual fee

- American Express Business Platinum Card – $799

- American Express Business Gold Card – $199

Given their annual fees (except the Green card), it’s important to maximize your return (MR points) for the annual fee(s) you have spent.

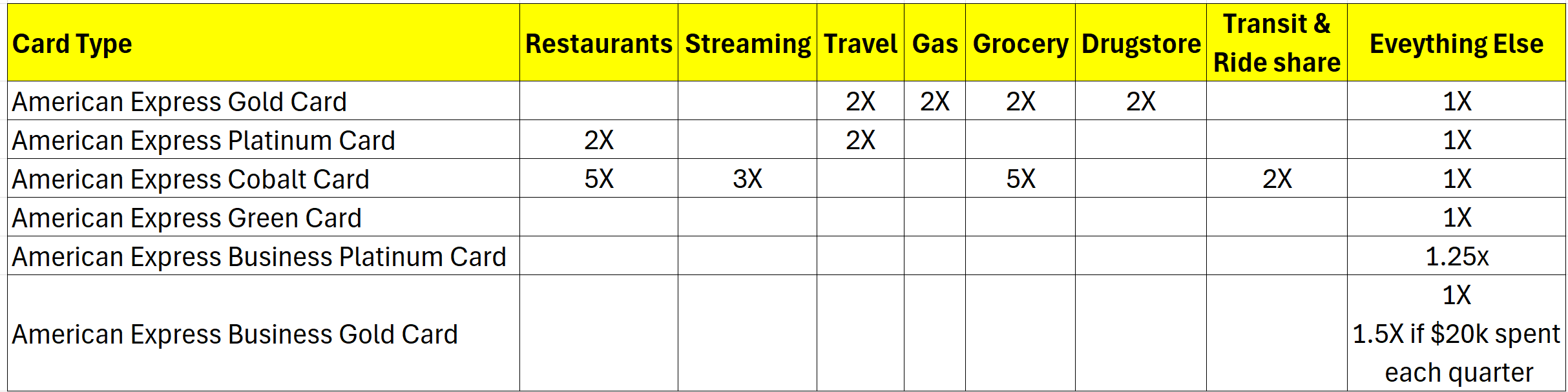

All Amex MR cards earn a base rate of 1 cent per dollar, except the Business Platinum. However, specific spending categories can yield up to a 5X earning rate. It’s imperative that you analyze your spending habits so that you can get the right cards(s) that will accelerate your MR growth. Dalia also discussed this in her post Credit Card Strategy for Beginners – Part 2. Here is a breakdown of the various earning rates for different merchants for each of the six cards:

The standout winner from this list for the majority of canadians the Cobalt card, that earns a whopping 5x points (up to $30,000/year) for a majority of categories that all households can benefit from such as groceries and restaurants spending.

The standout winner from this list for the majority of canadians the Cobalt card, that earns a whopping 5x points (up to $30,000/year) for a majority of categories that all households can benefit from such as groceries and restaurants spending.

The Gold or Platinum personal cards would be good cards to supplement the Cobalt as they fill the gap where Cobalt only earns 1X. Which is the right card between the two depends on whether you require the other benefits offered for each card. Dalia has offered some insight into this in her post, Credit Card Strategy for Beginners – Part 2, where she dives further into card benefits and how to consider these with the MR earning rates.

For business owners, the business platinum is a staple that is used by many as the extra 25% earn rate (1.25x), really accelerates MR growth when there are high expenditures. In fact, the business gold offers an even better 1.5x rate, albeit only on the first $20k spent in each quarter.

For business owners, the business platinum is a staple that is used by many as the extra 25% earn rate (1.25x), really accelerates MR growth when there are high expenditures. In fact, the business gold offers an even better 1.5x rate, albeit only on the first $20k spent in each quarter.

Earning membership rewards points isn’t restricted to earnings alone; it can also come from new card welcome bonuses, referrals, and promotions.

American Express Membership Rewards – Welcome Bonuses

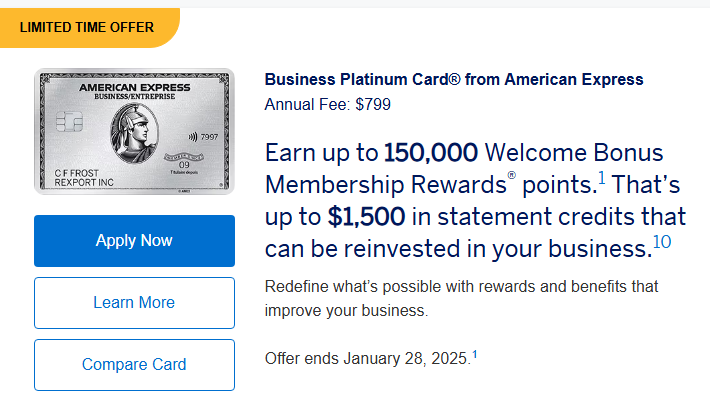

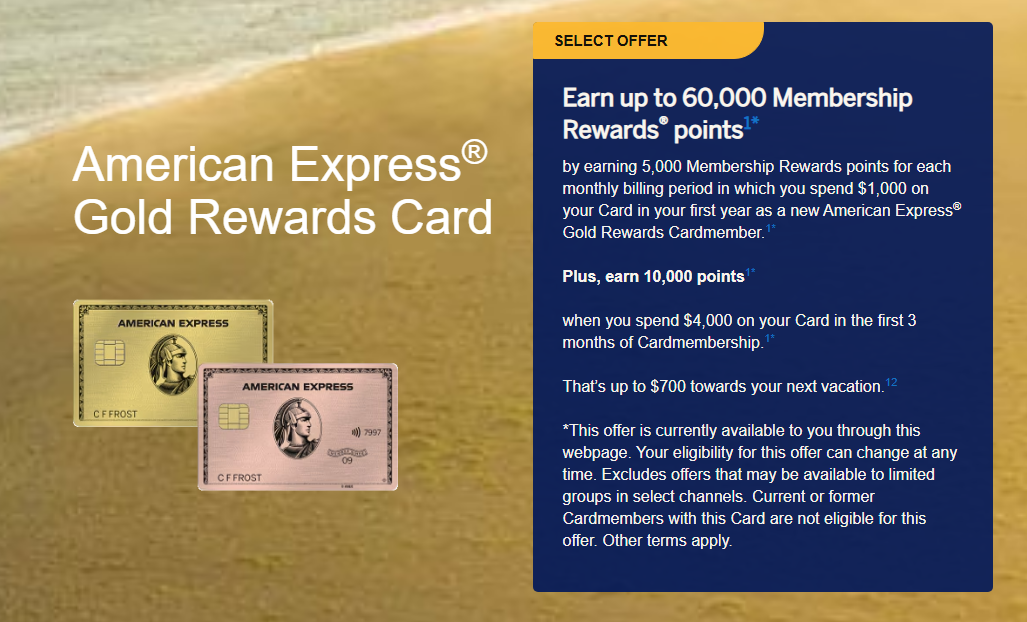

New card welcome bonuses provide cardholders with a quick accumulation of MR points. Therefore, taking advantage of offers is crucial when they are elevated beyond their usual levels. Stay informed of these offers by regularly visiting Points Miles and Bling, where we will always inform you of elevated card offers. Here are some recent offers from Amex Canada:

We talked earlier about choosing the right Amex MR card to give you the highest return for your type of spending. However, an elevated welcome bonus offer might prove to be a better deal. For example, a Business Platinum card offering 150,000 points with a $799 annual fee is a much better option than going with an Amex Personal Gold card that only offers 60,000 points with a $250 annual fee. Sure, the Gold card offers elevated MR earnings through its spending categories. However, this would have little impact on reducing the gap of 90,000 in the welcome bonuses between the two cards, at least in the first year. Additional nuances should also be taken into consideration, such as if the minimum spend requirement is feasible for you ($15,000 in 3 months) to accomplish. The Credit Card Strategy for Beginners – Part 2 thoroughly examines all these nuances.

American Express Membership Rewards – Referrals

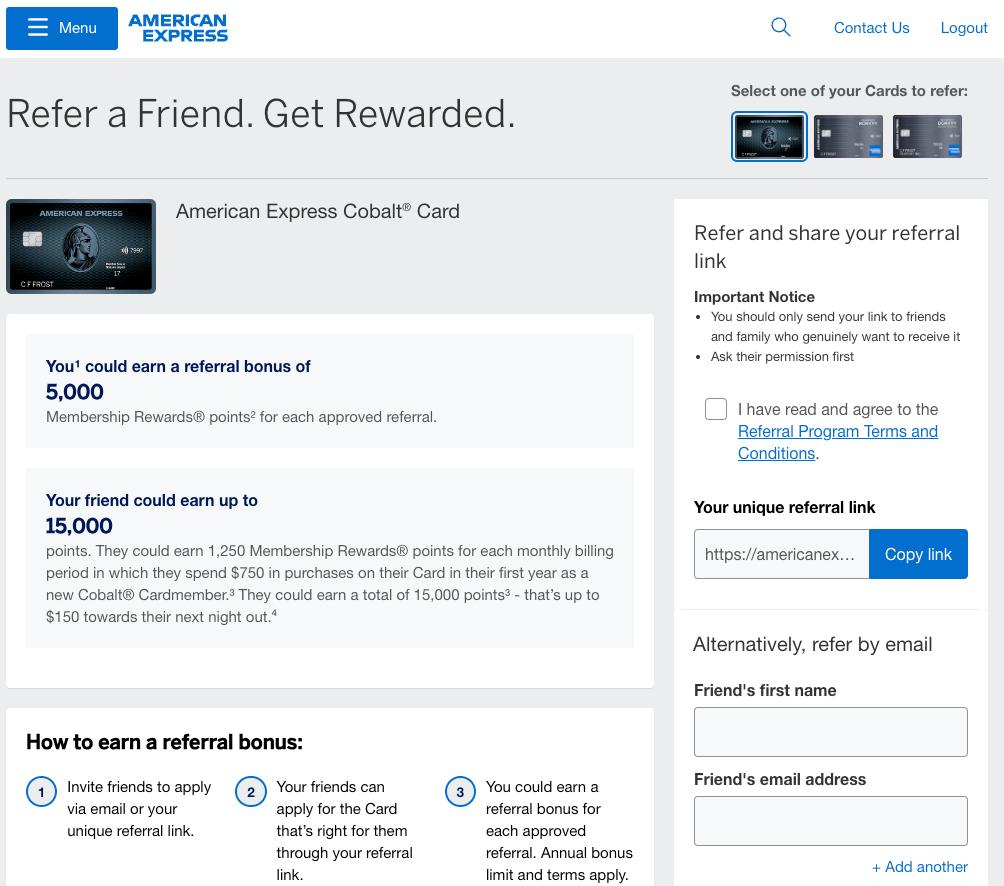

Amex encourages its cardholders to invite friends and family to sign up for their card, and in return, they award membership reward points for each referral.

The types of cards you can refer to depend on the card you are referring from. For example, an Amex Cobalt card cannot be used to refer to a business platinum card. The best cards to initiate referrals are:

- Business Platinum: earns 20,000 MR per referral up to 225,000/year and can refer to a Platinum, Business Gold, and a Platinum

- Business Gold: earns 15,000 MR per referral up to 75,000/year and can refer to any MR card

Compared to the others:

- Cobalt only earns 5,000 per referral

- Platinum earns 10,000 per referral and can refer to any MR card

- Gold only earns 7,500 per referral

The process to initiate a referral is quite easy:

The key point is that you can earn a substantial number of Membership Rewards (MR) points each calendar year through referrals if you fully take advantage of it. This should be important when deciding which American Express MR card to sign up for.

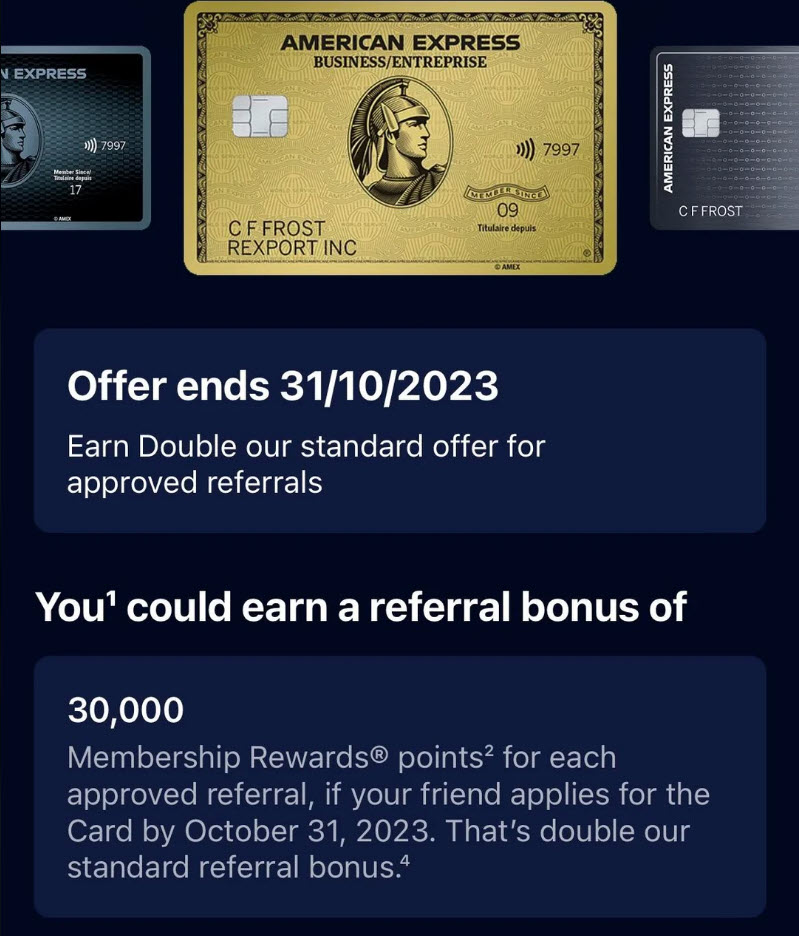

American Express Membership Rewards – Promotions

Amex Canada will often have promotions to accelerate MR earning potential. In the past, we have seen double or triple referral bonuses and purchase bonuses at specific merchants:

If you can take advantage of such promotions, your potential to earn MR can significantly increase.

Summary

In the second part of our series on American Express (Amex) Membership Rewards (MR), we explored different types of cards that earn MR and discussed strategies to optimize spending to unlock maximum earning potential. We focused on leveraging spending habits and taking advantage of new card welcome bonuses. However, earning MR doesn’t stop there—Amex provides additional opportunities to earn MR through referrals and special promotions. Next, part 3 of this guide will examine all these redemption possibilities, whether first-class flights, five-star hotels, or just straight cash back.