Table of Contents

Points Miles and Bling (blog) contains referral or affiliate links. The blog receives a small commission at no additional cost to you. Thank you for your continued support. Credit Card issuers are not responsible for maintaining or monitoring the accuracy of information on this website. For full details, current product information, and Terms and Conditions, click the link included.

What is Chexy, and why use it?

Put simply, Chexy is a Canadian payment platform that lets you earn credit card rewards on everyday expenses like rent, taxes, insurance, utilities, gym memberships, and other bills – turning expenses that traditionally cannot be paid for using credit cards into points-earning opportunities.

For many people, rent and other fixed monthly bills are their largest expenses, but earning points on these expenses is not so straightforward. If your landlord only accepts cheques and e-transfers, it can feel a bit wasteful to miss out on points for a $2,000+ purchase every month, and with Chexy, you won’t have to.

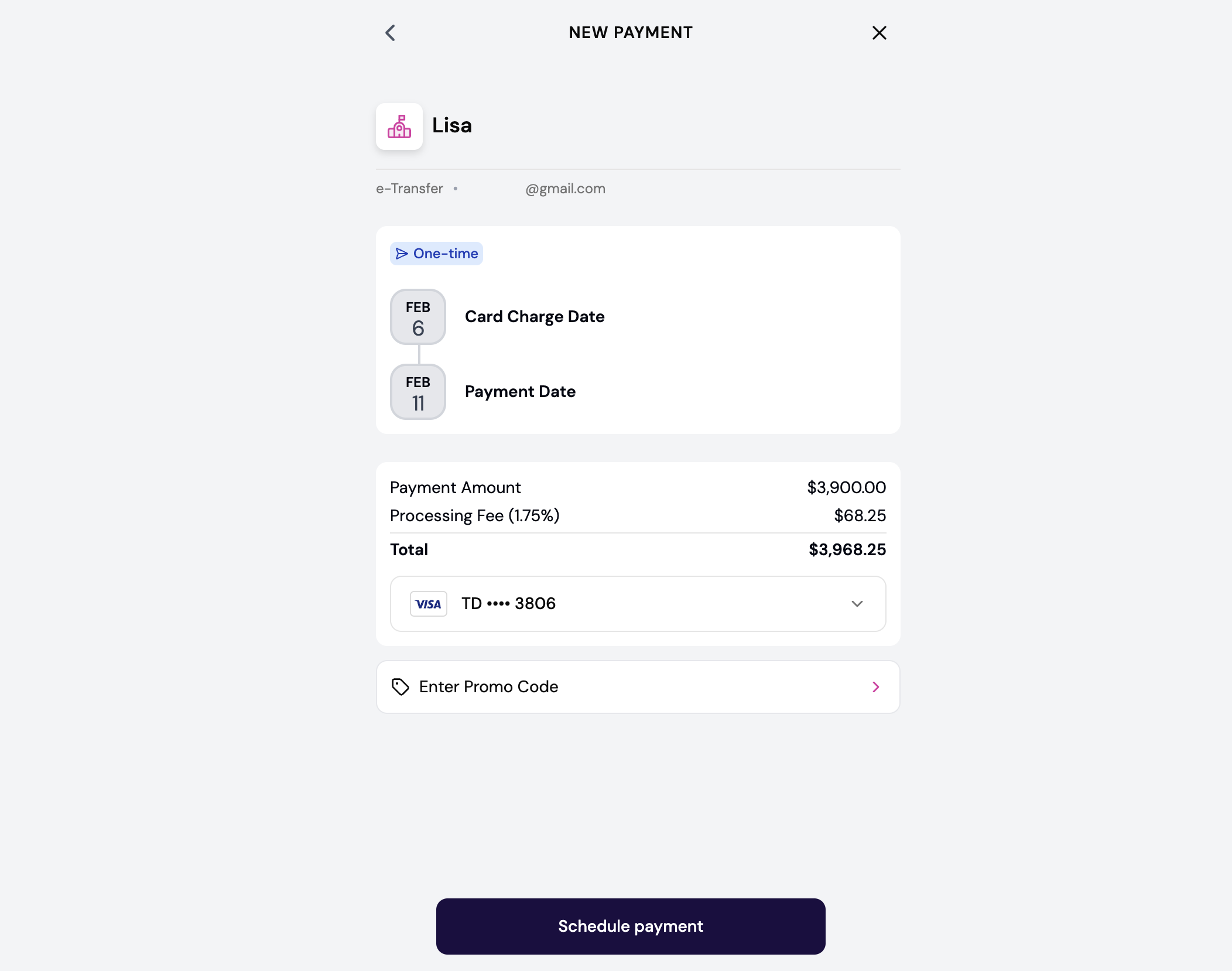

Chexy payments can be recurring or one-time payments, allowing the flexibility to set up payments based on the expense. Rent can easily be set up as a recurring expense, while something like paying your child’s tutor can be done as a one-time transaction.

How It Works

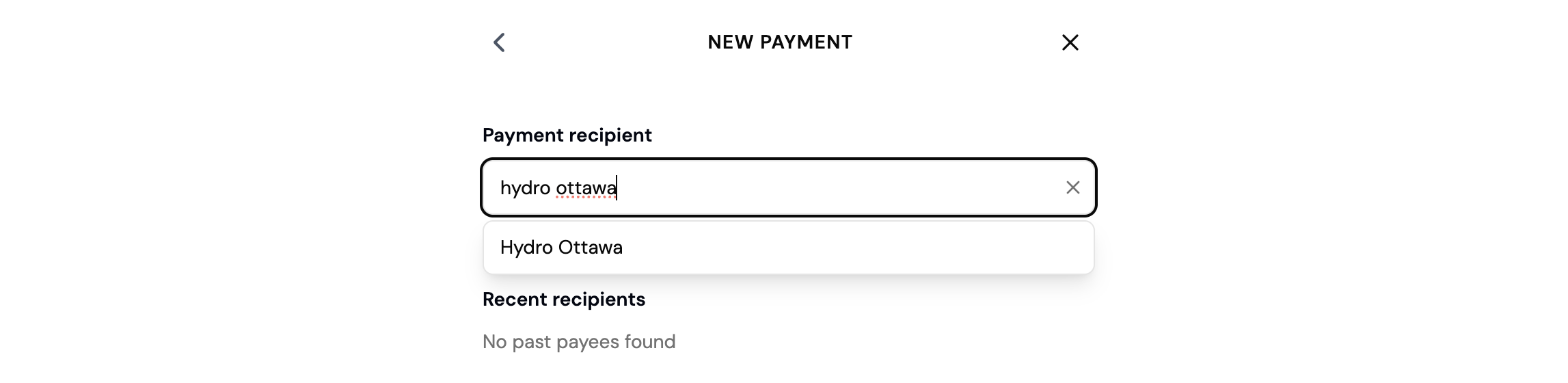

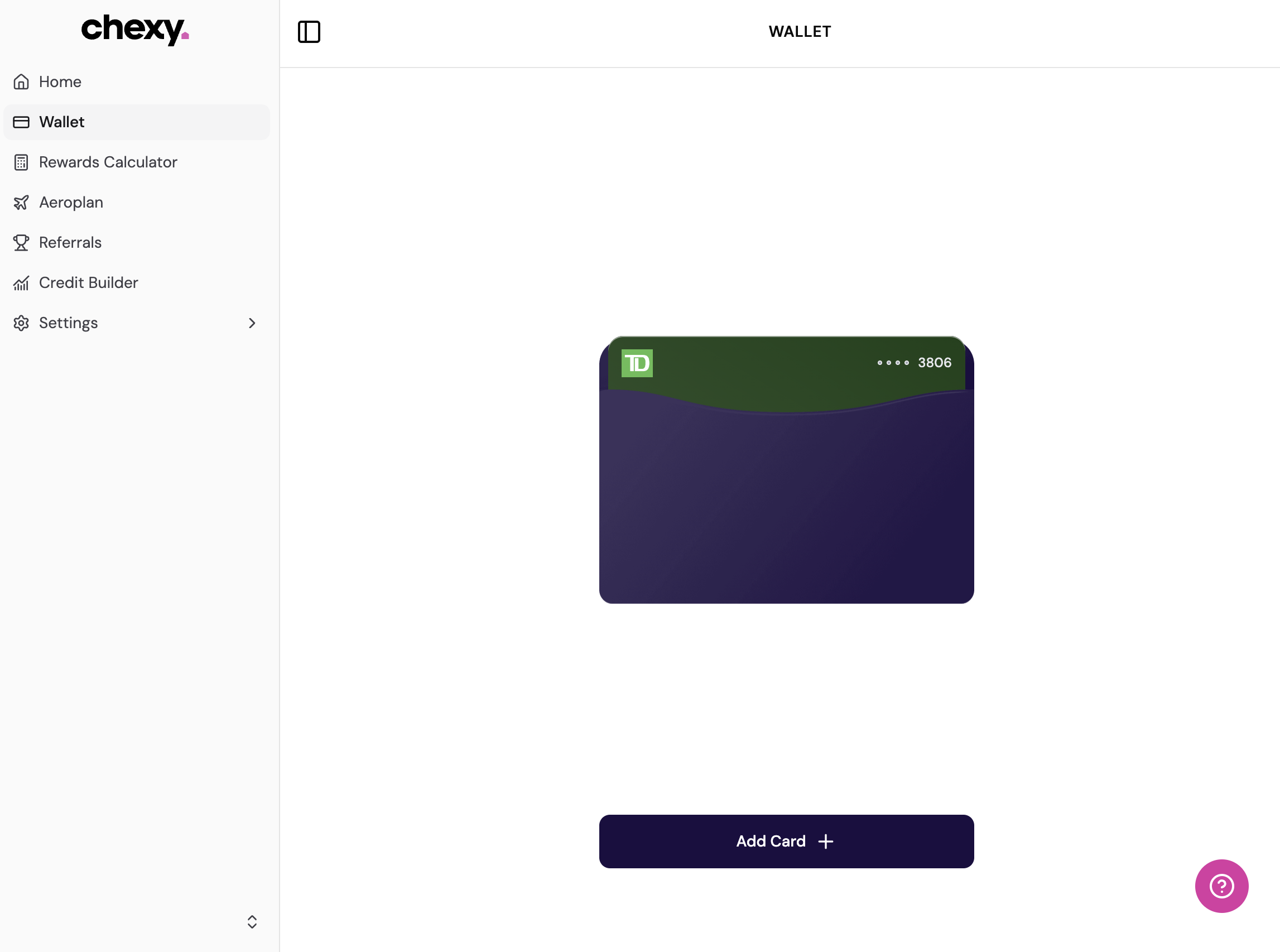

Sign up for a Chexy account, add your credit card(s), and then set up the payments you want to make through the platform. For example, this could be rent, taxes, tuition, the contractor building your patio, your child’s tutor or any other one-off or recurring expenses.

Think of Chexy as the middle layer between you and the payee. Chexy charges your credit card three days before the payment is due, then sends the payment on your behalf using the payee’s preferred payment method (compatible only with Interac e-Transfer, pre-authorized debit, or bill pay).

Recently, Chexy introduced the ability to add up to five credit cards to a single account, allowing you to choose the best card for each payment and therefore maximize rewards across different cards.

Does Chexy Charge Fees?

The short answer is yes – for Canadian Visa and Amex cards, Chexy charges a 1.75% fee, while international credit cards are subject to a 2.5% fee.

We know that all points are earned via the interchange fee Visa or Amex charges and traditionally paid by the vendor. In Chexy’s case, we can assume this fee is passed onto the customer, and per Chexy, the value of the points earned through these transactions is designed to fully offset the cost of the fees.

We know that all points are earned via the interchange fee Visa or Amex charges and traditionally paid by the vendor. In Chexy’s case, we can assume this fee is passed onto the customer, and per Chexy, the value of the points earned through these transactions is designed to fully offset the cost of the fees.

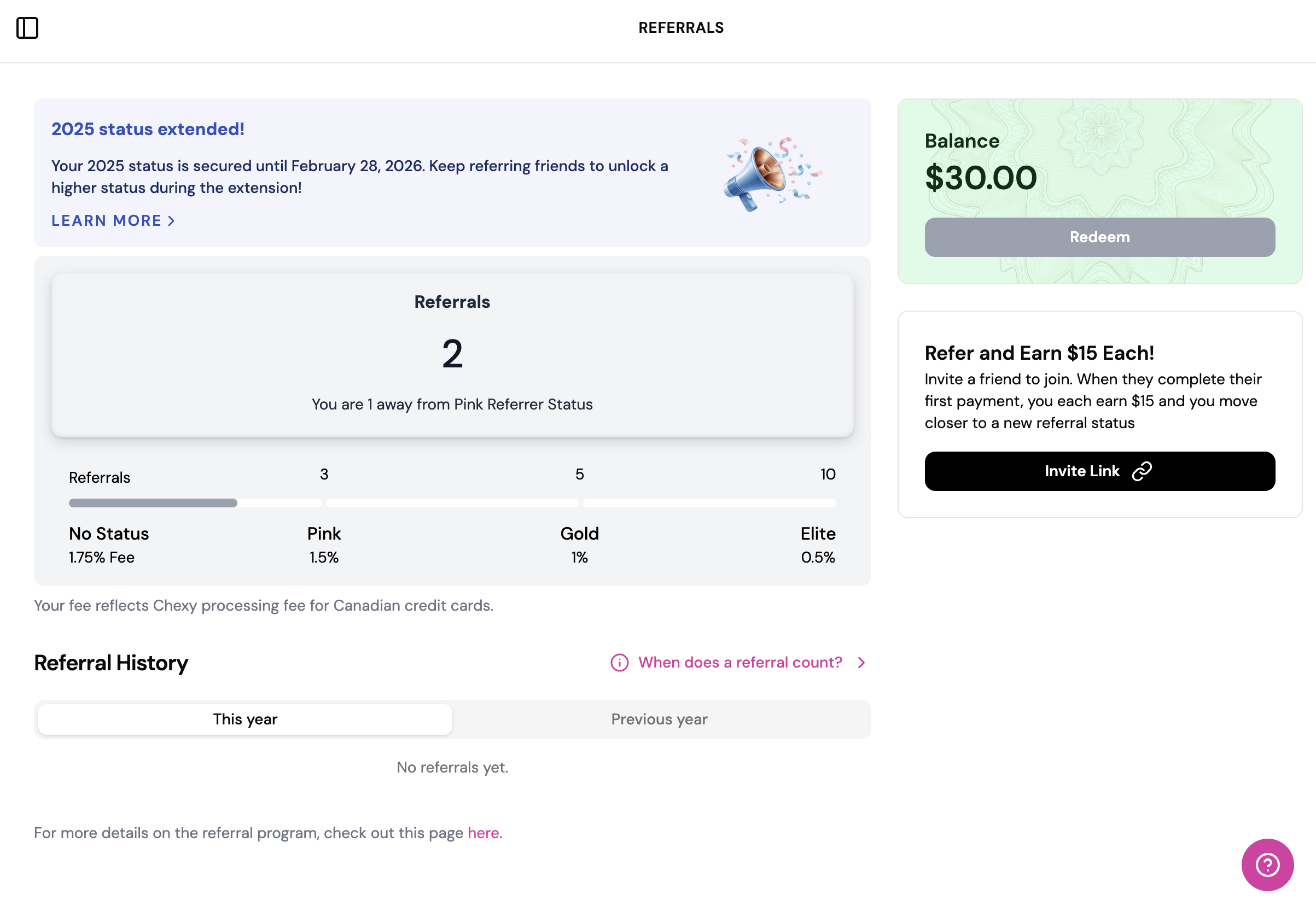

However, note that there are also opportunities to lower these fees through their referral program.

By referring friends to Chexy, you unlock lower processing fees on your own payments over time. If the friends you refer continue using Chexy, you can extend your referral status into the following year (new for 2026).

Lowering Chexy Fees via Referral Program

By successfully referring a friend to Chexy, your friend receives $15 cashback after completing their first payment. As you refer more people, your own transaction fees go down as follows:

- 1 referral, and both you and your friend receive $15 cashback (Starter)

- 3 referrals: processing fee drops to 1.5% (Pink)

- 5 referrals: processing fees drop to 1% (Gold)

- 10 referrals: processing fees drop to 0.5% (Elite)

Note decreased processing fees apply only when using Canadian credit cards (more on international cards later), and at every level, those you refer receive $15 cashback on their first payment.

Referrals also reset on March 1 of each year, and your earned promotional rates only apply for the rest of the year, so it’s optimal to refer friends as early on as possible to maximize the period of discounted spending.

New for 2026 is the ability to extend your referral status into 2027. Instead of needing to refer new people each year, Chexy now looks at how many completed payments your referred friends make throughout 2026.

If the people you refer (which Chexy calls your “crew”) complete a certain number of payments, your status will be automatically extended into 2027:

- 15 completed payments = 1.5% processing fee (Pink)

- 50 completed payments = 1% processing fee (Gold)

- 250 completed payments = 0.5% processing fee (Elite)

To be clear, only your existing status extends to 2027 – so if you refer 5 people (Gold) and those 5 people complete 250 payments, your Gold status would be extended, and you do not “upgrade” into Elite status.

For users paying with international credit cards, the referral program works slightly differently. Instead of moving to a fixed reduced fee, each referral status provides a discount off the higher international rate.

- 3 referrals: processing fee is discounted 0.25% = now 2.25% (Pink)

- 5 referrals: processing fee is discounted 0.75% = now 1.75% (Gold)

- 10 referrals: processing fee is discounted 1.25% = now 1.25% (Elite)

Irrespective of the credit card used (whether Canadian or international), discounts only apply to the first $50,000 spent. Any dollars you spend through Chexy beyond that will be charged at the regular rate (1.75% for Canadian credit cards and 2.5% for international credit cards).

Aeroplan Welcome Offer for New Chexy Members (Limited Time)

Chexy currently has a promotion for Aeroplan members, available until January 31, 2026, where you can earn up to 5,000 Aeroplan points. Earn 1,000 points when you create a Chexy account and complete your first payment; earn 3,000 points after you process $3,000 in total payments through Chexy (fees are excluded from this amount); and earn 1,000 points after completing 12 consecutive monthly payments.

Is Chexy Worth it for You?

Whether Chexy is worth using ultimately comes down to what you’re trying to achieve.

For most of us, the biggest value comes from using Chexy strategically to unlock credit card bonuses or benefits that would otherwise be difficult to reach with everyday spending.

In terms of maximization, the best ways to make Chexy work for you are by unlocking new credit card welcome bonuses or credit card benefits that only occur after spending $X amount.

For example, you can earn 25K Aeroplan status by spending $125,000 on a premium Aeroplan co-branded card (TD Aeroplan Visa Infinite Privilege, CIBC Aeroplan Visa Infinite Privilege, American Express Aeroplan Reserve Card).

That said, every person can make Chexy work for them, and you should be using Chexy on as many recurring transactions as possible, as it’s easy to come ahead of the 1.75% fee (assuming you make zero referrals, aka paying the highest possible fee) simply by using the right credit card.

When Does it Make Sense to Use Chexy?

Case Study 1: Using Chexy to Meet a Welcome Bonus

Let’s say you’ve just been approved for the TD First Class Travel Visa Infinite Card, which is offering at present:

- 20,000 TD Rewards Points as a welcome bonus when you make your first Purchase with your Card

- 145,000 TD Rewards Points when you spend $7,500 within 180 days of Account opening

$7,500 might not sound like such a high spending requirement spread over six months, but it’s likely you want to earn the full welcome bonus in a faster timeframe, which is where Chexy comes in.

Again, assuming your rent is $2,000 per month, you will be paying $35 per month in Chexy fees (assuming no referrals and thus a fee of 1.75%). To reach the full $7,500 required, you will be paying rent for 4 months (assuming you are not doing any other spending on this card) and therefore paying a total of $140 in Chexy fees.

However, in exchange for that $140, you’ll be earning 165,000 TD points worth $825 when redeemed on Expedia for TD. Subtracting the Chexy cost, you’re coming out ahead by a cool $685. Keep in mind you will also spend less in Chexy fees by putting some of your regular spending on the card.

With a few referrals to friends and family, your processing fees drop even further.

Case Study 2: Paying Taxes with Chexy

The two certainties of life – death and taxes. While we cannot remove either, we can at least earn a plethora of points on the second.

If you forgo paying taxes directly to the CRA using Interac e-Transfer or bill payment and instead pay using your credit card through Chexy, you will at least earn an abundance of points (or money if using a cash back credit card) and can even combine with Case Study 1 to unlock a new welcome bonus.

Say you owe $5,000 in taxes. At 1.75% (again, assuming you refer zero people), your fee would be $87.50. $5,000 is enough to earn welcome bonuses on quite a few cards:

- RBC British Airways Visa Infinite, where you earn 30,000 Avios by spending $5,000 in the first 3 months (and another 30,000 by spending another $5,000 in months 4-6)

- Cathay World Elite Mastercard, where you earn 60,000 Asia Miles by spending $5,000 in the first 3 months

Keep in mind, your fees go down to $75 if you refer just 3 people, and even lower if you refer more than that.

When filing taxes, there are two main steps: figuring out how much money you owe and then actually paying the CRA accordingly. Chexy has the second part covered, but in regard to the first … TurboTax is likely a service you’ve either heard of or are already using.

TurboTax offers (20% off – claim offer) multiple tiers based on user needs, and the price ranges from $0 (simple tax situations like T4-only) to $60 (more complex cases like self-employed). Currently, you can also take advantage of two different Amex Offers available to lower the cost – earn a $15 credit when spending at least $60 or earn a $50 credit when spending at least $175.

To summarize the fine print, $60 or $175 can be spent in a single transaction or cumulatively, and you can make a payment at turbotax.ca/amex. Make sure to first register for the offer on the American Express website or mobile app.

The Verdict – Is Chexy Worth the Fees?

For recurring payments, using Chexy is a no-brainer. Add the Scotiabank Momentum Visa Infinite to your Chexy wallet and earn a 4% return on all recurring payments. Even with the chexy fees, you net 2.25% cash back on all your recurring transactions (even lower if you refer a few friends).

For the rest, whether Chexy makes sense comes down to the numbers. You will need to do your own math to decide if the processing fee is worth paying in exchange for the rewards, cashback, or welcome bonuses you’re working towards.