Points Miles and Bling (blog) contains referral or affiliate links. The blog receives a small commission at no additional cost to you. Thank you for your continued support. Credit Card issuers are not responsible for maintaining or monitoring the accuracy of information on this website. For full details, current product information, and Terms and Conditions, click the link included.

There’s no getting around it: the American Express Platinum Card comes with one of the highest annual fees of any credit card in Canada. Despite that, it continues to hold its reputation as the flagship luxury travel card.

However, the Platinum Card has two very useful statement credits available to cardmembers. When used strategically, these credits can go a long way toward offsetting the annual fee, so let’s break down exactly what’s on offer.

$200 Travel Credit

Cardmembers receive a $200 travel credit each year, renewed on their anniversary date. This credit is identical to the one offered on the Business Platinum and is used exactly the same way – you can book anything available on the Amex Travel portal.

You are charged the full booking amount, and a $200 statement credit appears a few days later.

$200 Dining Credit

Unlike the travel credit, the $200 dining credit is set by calendar year.

You also have to register for the Amex Offer on the Amex website or mobile app.

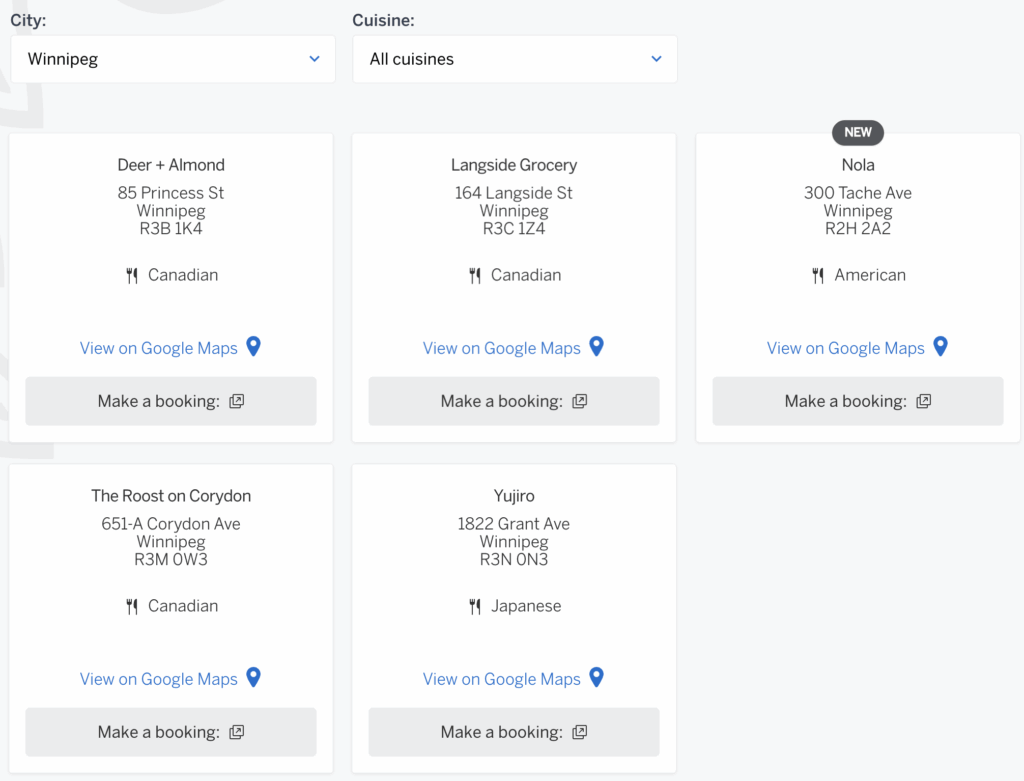

In the past couple of years, the number of restaurants outside of major cities has increased significantly, so now you can find restaurants in the likes of Regina, Moncton, and Winnipeg.

Eligible restaurants in Winnipeg

You must spend at least $200 in a single transaction to trigger the dining credit, but that amount is after taxes and gratuity, provided the charge on your credit card reflects at least $200.

For what it’s worth, a gift card should trigger this credit as long as it’s processed in-store, as it will show up on the credit card statement exactly the same as if you had dined in. I’ve personally done this two years in a row at Arlo in Ottawa (10/10 restaurant by the way) since I forgot about the dining credit until the end of the year.

The major thing to watch out for with this $200 dining credit is if you’re dining inside a hotel. You’ll want to ensure the charge is posted to your credit card by the merchant, not the hotel.

If you do cancel The Platinum Card after using your dining credit, for example, if you used the dining credit more than once per annual fee payment, there is a chance Amex will rebate your annual fee minus this credit. The best chance of success would be to cancel your credit card mid-cycle and not

$240 Instacart Credit

Like the $200 travel credit, the Instacart credit is identical to the Business Platinum by American Express.

Amex Platinum cardholders are eligible for a $10 Instacart credit twice per month, for a total of $20 per month or $240 per year.

Instacart boomed in popularity during the pandemic and has continued to be a household staple (fun fact, one of Instacart’s co-founders is a UWaterloo grad). Think of it as Uber Eats for groceries (yes, I know Uber Eats now offers groceries, too).

Compared to shopping in-store, you can expect a small mark-up on most items, as well as service and delivery fees. Many of these can be mitigated with the paid Instacart+ service, which is included for 6 months free on many credit cards, including the BMO VIPorter World Elite Mastercard.

A fun trick to use both $10 monthly credits on the same order is to place an order of at least $10, then add new items to the cart of at least $10 more before shopping begins. With this method, you’ll be charged in two separate transactions of at least $10.

A fun trick to use both $10 monthly credits on the same order is to place an order of at least $10, then add new items to the cart of at least $10 more before shopping begins. With this method, you’ll be charged in two separate transactions of at least $10.

Remember that Instacart isn’t only for groceries; you can also shop at pet stores, drugstores, and Costco.

$100 Nexus Credit

Like how the U.S. has TSA Precheck and Global Entry, Canada has NEXUS. Well, sort of, as Nexus is shared with the U.S. as a dual-country trusted traveller program that also includes TSA Precheck and Global Entry.

The Amex Platinum offers a $100 statement credit every four years, which helps to offset the $120 USD fee. I had hoped the credit would increase in value as the Nexus price rose from $50 USD to $120 USD, but that has not yet occurred.

Is the American Express Platinum Card Worth It?

Doing some simple math, the annual fee is $799, and we can deduct the following annual credits:

- $200 travel credit

- $200 dining credit

- $240 Instacart credit

That brings the net annual fee to $159. I opted not to include the Nexus since it’s once every four years, but using it lowers the net annual fee for the year you apply or renew your Nexus.

$159 is well worth it when you factor in additional benefits such as unlimited lounge access (through 2027), access to Amex Fine Hotels + Resorts, and complimentary Gold status with Marriott and Hilton.

If you’re choosing between the Platinum Card and the Business Platinum Card, it comes down to which set of Amex Offers you find more advantageous. While the Business Platinum’s $200 Dell credit and $300 Indeed credit are both higher than the Platinum’s $200 dining credit, I bet the second is not only easier to use, but also more enjoyable.

Compared with the Business Platinum, the personal Platinum also earns 2 MR per dollar spent in travel and dining, while the Business Platinum earns 1.25 MR per dollar spent on all purchases. Which is best depends on your spending patterns.

Takeaway

Many people keep the American Express Platinum Card as their default premium travel card. By taking advantage of the Amex Offers available to cardholders, you can easily cut your annual fee by over 80% and stay at a nice hotel and enjoy a fancy meal or two while you’re at it.