Points Miles and Bling (blog) contains referral or affiliate links. The blog receives a small commission at no additional cost to you. Thank you for your continued support. Credit Card issuers are not responsible for maintaining or monitoring the accuracy of information on this website. For full details, current product information, and Terms and Conditions, click the link included.

Tangerine offers two of the most underrated cashback credit cards in Canada, the no-annual fee Tangerine Money-Back Credit Card, and Tangerine World Mastercard. Currently, both cards offer an additional 10% cashback (up to $100) on everyday purchases made within the first 2 months of card membership, for applications approved by May 2, 2023. An excellent sign up bonus on a no annual fee credit card that earns 2% Money-Back Rewards in two categories of your choice.

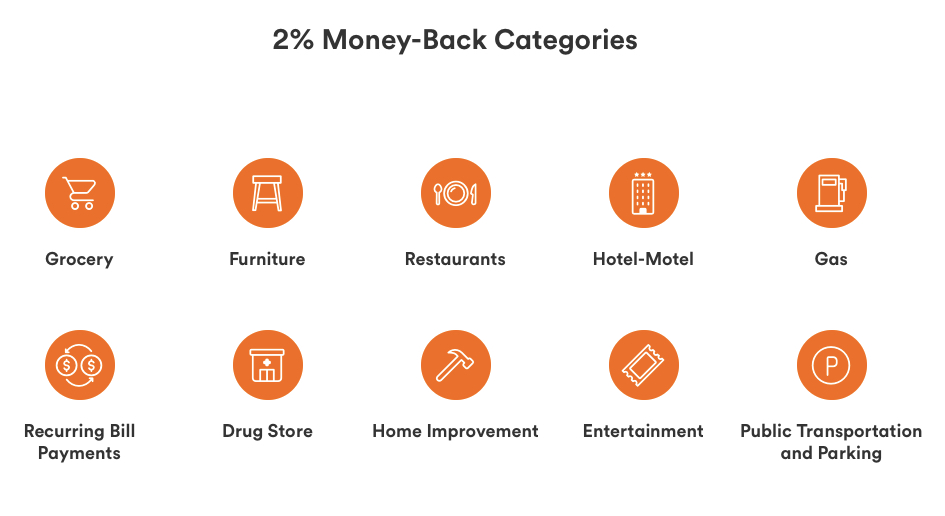

Tangerine Cashback Categories

Cardmembers can select two categories for 2% Money-Back Rewards. However, members can get a third 2% Money-Back Category by choosing to deposit the rewards into their Tangerine Savings Account.

Pro-tip: Walmart stores in Canada code as grocery, and earn the 2% Money-Back on all purchases.

Assuming a monthly spend of $2,000 across 2% Money-Back categories, these cards would earn $40 monthly, or $580 yearly (incl $100 bonus). But it does not have to stop there since the 2% Money-Back Rewards have no yearly limit.

Tangerine World Mastercard – Apply Now

-

- Fee: No annual fee

- Welcome Bonus: Additional 10% back when you spend up to $1,000 in everyday purchases within your first 2 months of card membership

- Standard Earning Rate: 2% money-back on two categories, no limit

- Key Features:

- Boingo Wi-Fi for Mastercard: Keep you connected with access to over 1 million Wi-Fi hotspots around the world with Boingo Wi-Fi

- Mastercard Travel Pass provided by DragonPass: Complimentary membership with access to over 1,300 airport lounges at $32 USD per visit

- Rental Car Collision/Loss Damage Insurance: Damage and theft protection for your car rental when you rent and charge the full cost of your rental to your Card

- Mobile Device Insurance: Up to $1,000 if mobile device is lost, stolen, accidentally damaged or experiences mechanical failure

- Mastercard Travel Rewards: Pay with your enrolled Mastercard to enjoy automatic cashback offers online and in-store from participating merchants

Detailed list of benefits and perks of the card are listed here

Tangerine Money-Back Credit Card – Apply Now

- Fee: No annual fee

- Welcome Bonus: Extra 10% back (up to $100) when you spend up to $1,000 in everyday purchases within your first 2 months

- Standard Earning Rate: 2% money-back on two categories, no limit

Detailed list of benefits and perks of the card are listed here

Take Away

Made with 100% recyclable plastic, both Tangerine credit cards offer strong earning potential for Canadian households, especially with the no limit on 2% Money-Back Rewards. The current promotion adds an additional $100 to these strong no-fee cashback credit cards if you apply by May 2, 2023.

Title Image Credit: Tangerine