Points Miles and Bling (blog) contains referral or affiliate links. The blog receives a small commission at no additional cost to you. Thank you for your continued support. Credit Card issuers are not responsible for maintaining or monitoring the accuracy of information on this website. For full details, current product information, and Terms and Conditions, click the link included.

Tims® Mastercard is a no-annual-fee card that offers Tims® Rewards points, 15 points per $1 at Tim Hortons restaurants and up to 5 points per dollar on everyday essentials. New card members can get up to 5,000 points. Cardmembers can convert their points into a statement credit of up to $45 weekly by redeeming points for up to 2% back on essentials and up to 6% back at Tims (scanning for Tims Rewards).

Tims Mastercard – Apply Now

- Annual Fee: $0

- Welcome Bonus: Up to 5,000 points

- 2,000 points for your first purchase in month one

- 3,000 additional points – 1,000 points for spending $200 or more each month with the card for three months

- Earn Rate:

- 15 points per $1 when you scan for Tims Rewards

- 5 points per $1 on groceries, gas, EV charging, transit, taxi and rideshares

- 1 point per $2 everywhere else

- Redemption Options:

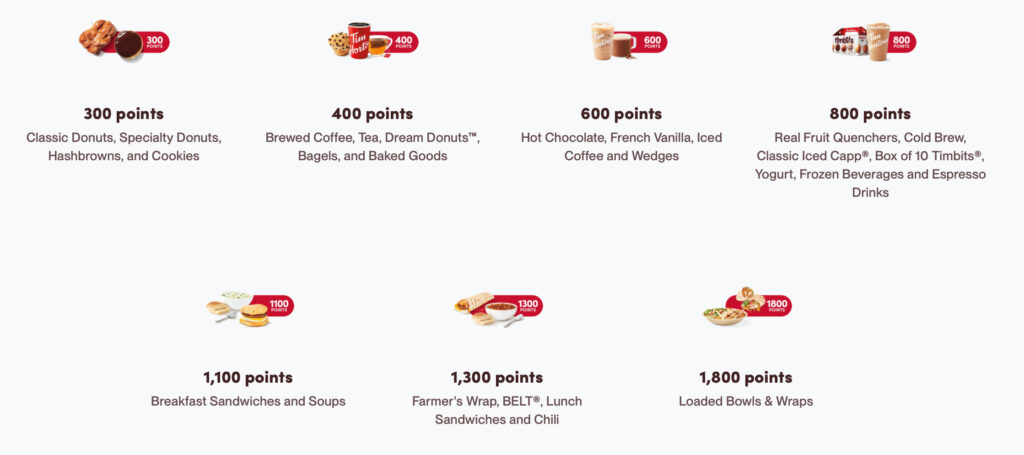

- Redeem points for Tim Hortons menu items

- 6% back in statement credit (up to $45 in statement credit each week)

- 6% back when you Scan for Tims Rewards with Tims Mastercard

- 2% back on Groceries, Gas, EV charging, Transit, Taxi & Rideshare

- Additional Benefits:

- Extended Warranty: Extend the manufacturer’s warranty for your purchases for up to one year. From gadgets to appliances, your purchases are protected.

- Purchase Protection: Most items you buy using your Tims Credit Card are covered for 90 days after purchase. If anything goes wrong, you’re covered for repairs, replacements, or reimbursements up to $1,000 per incident.

- Mastercard Zero Liability: Your card protects against unauthorized purchases, ensuring that you’re not liable for any unauthorized transactions on your card.

- Mobile Payment Convenience: Add your Tims Credit Card to your Apple Wallet or Google Wallet for seamless mobile payments wherever Mastercard is accepted.

- Real-time Notifications: Stay informed with real-time transaction notifications so you’re always aware of your spending.

Refer to the Tims page for up-to-date offer terms and conditions

Tims Mastercard – Takeaway

Tim Horton’s standard redemption options

Whether you’re a Tim Hortons enthusiast, a frequent shopper, or someone who wants to make the most out of their credit card, this is your opportunity to unlock an array of exciting rewards and benefits. With points that effortlessly accumulate, an impressive welcome offer, and a suite of benefits that add convenience and peace of mind to your everyday life, this card is a must for all Tim Hortons aficionados.