Table of Contents

Points Miles and Bling (blog) contains referral or affiliate links. The blog receives a small commission at no additional cost to you. Thank you for your continued support. Credit Card issuers are not responsible for maintaining or monitoring the accuracy of information on this website. For full details, current product information, and Terms and Conditions, click the link included.

Upon first glance, the Business Platinum Card from American Express has a high annual fee. However, there are many tangible benefits on offer, such as lounge access, travel credits, hotel status, and more.

One of the major ways to offset the high annual fee is with various credits you can take advantage of just by being a cardmember, so let’s take a look at those below.

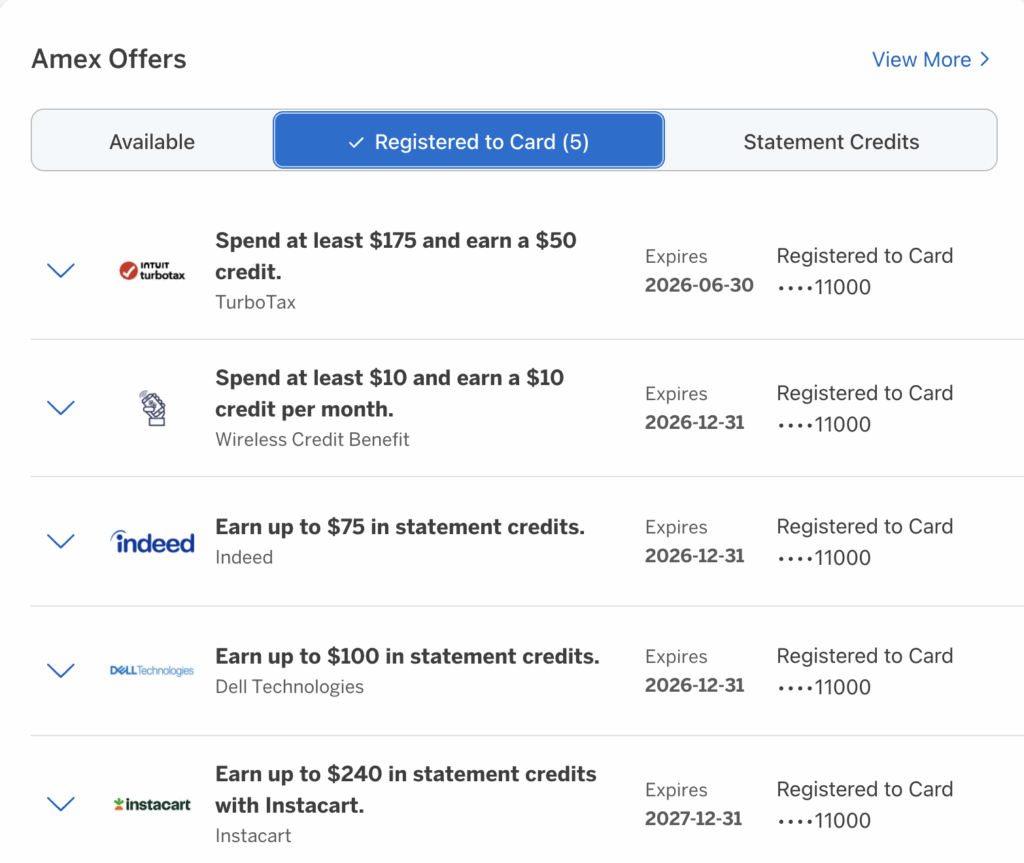

Registering for Amex Offers

Most of these benefits need to be registered for in advance, so be sure to do so via the Amex website or the mobile app.

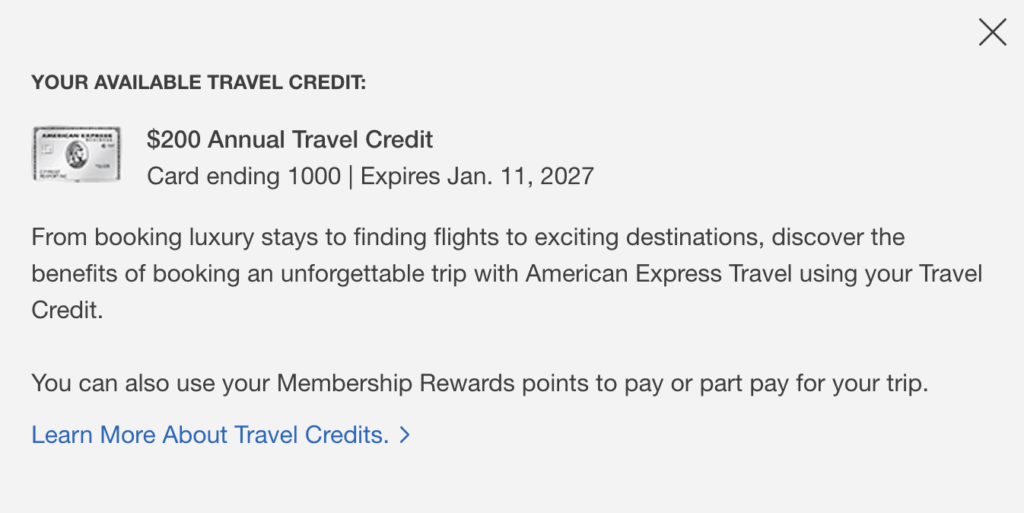

$200 travel credit

Cardmembers receive a $200 travel credit every year, renewed on the cardholder’s anniversary date. This credit is very simple to use with any booking made with Amex Travel – it can be a flight, hotel, car rental, or anything else. Be sure to select this credit card, and the $200 travel credit should be visible.

How it works is you are charged the full amount of the booking, and then a $200 statement credit shows up a few days later.

How it works is you are charged the full amount of the booking, and then a $200 statement credit shows up a few days later.

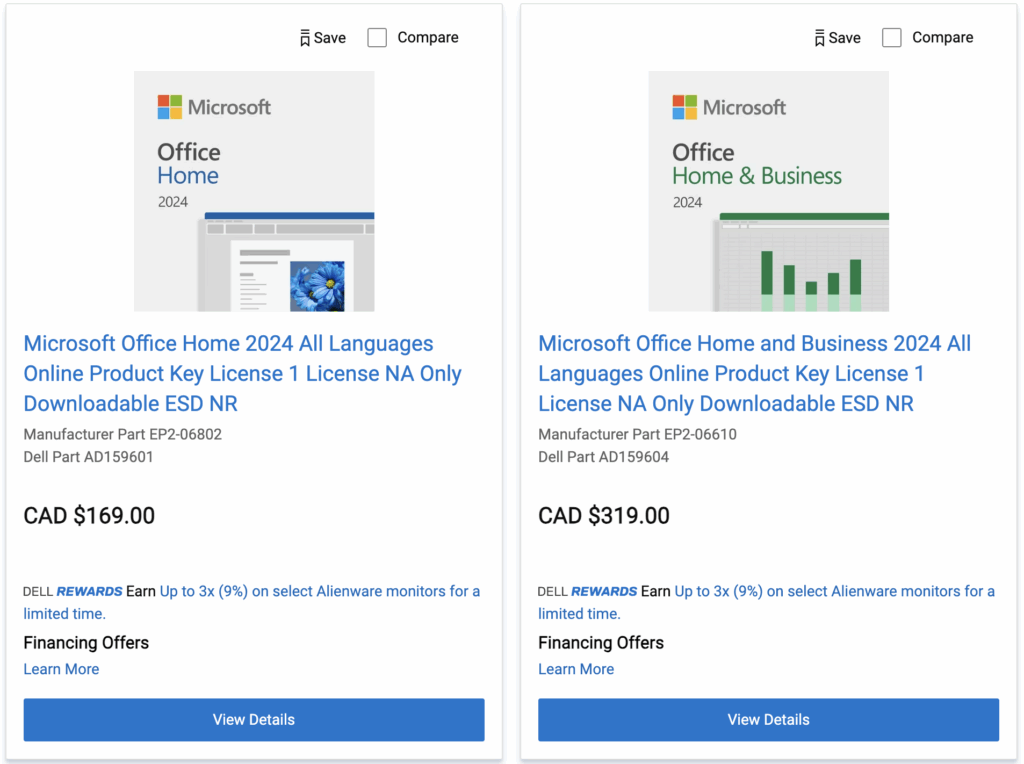

$200 Dell Credit

The $200 annual Dell credit is broken into $100 every six month,s with defined periods of January 1 – June 30 and July 1 – December 31.

Any purchase made on the Dell Canada website qualifies, and Sash and I use ours to buy product licenses for the Microsoft Office suite.

Note Dell will charge your credit card when the item ships, not the day you make the purchase so be sure to buy something a few days before June 30 or December 31 to make sure the credit posts for the right time period.

Note Dell will charge your credit card when the item ships, not the day you make the purchase so be sure to buy something a few days before June 30 or December 31 to make sure the credit posts for the right time period.

$120 Wireless Credit

The $120 wireless credit is posted as a monthly $10 credit and is worth its face value as long as you bill your wireless service to your Business Platinum.

This is an easy to set it and forget situation by leaving your Business Platinum as the pre-authorized payment card with Rogers, Bell, or whoever your service provider is.

Accepted service providers are any as defined by the Canadian Radio-television and Telecommunications Commission (CRTC) and Sasktel and the service provider needs to accept Amex in order to receive the $10 monthly credit.

$300 Indeed Credit

The $300 Indeed credit is broken down into $75 per quarter, with each period beginning on the first day of January, April, July, and October.

This credit may or may not be useful depending on the size of your business and whether you pay for sponsored job advertisements.

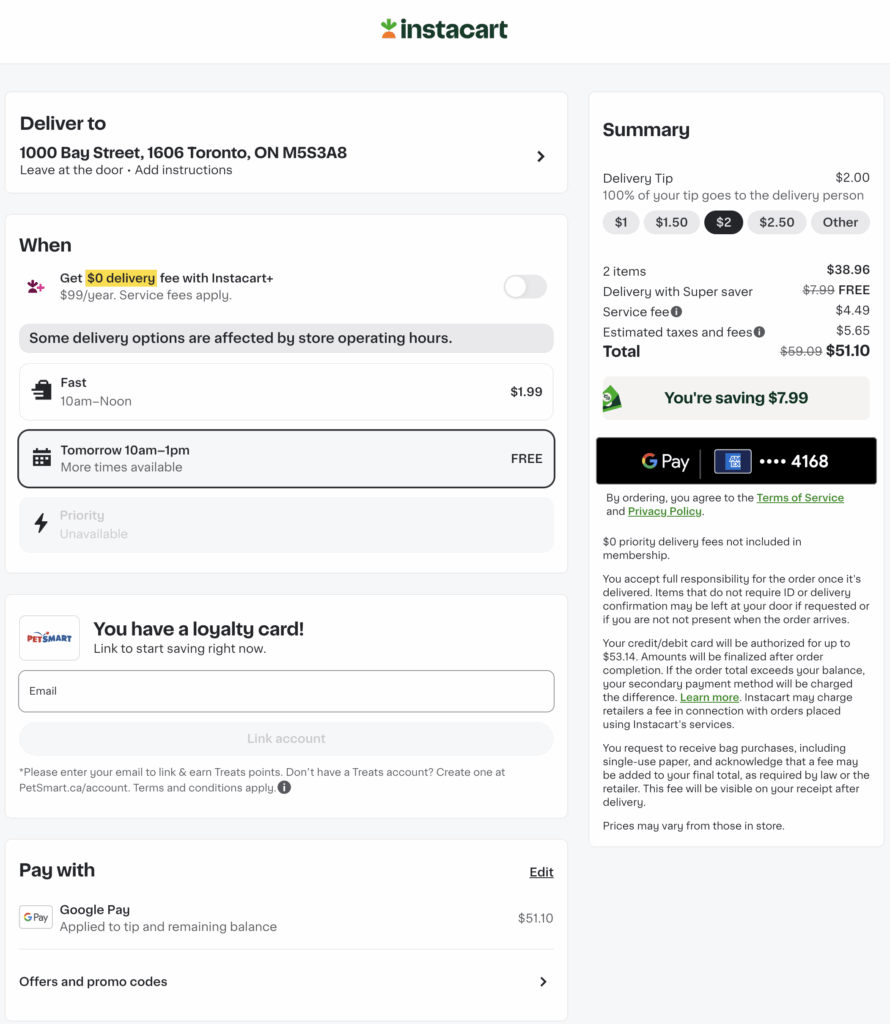

$240 Instacart Credit

Twice a month, you are eligible for a $10 Instacart credit (total $20 per month), which adds up to $240 over the course of a year.

Instacart is a grocery delivery service and will deliver for free on orders of $35 and up. You can expect a small markup compared to purchasing items in-store, and also a service fee. If you have Instacart+, the $35 minimum for free delivery is waived as well.

Keep in mind, Instacart isn’t only for perishable groceries, but many drug stores, Costco, and pet stores are also available.

One way to use both $10 credits on the same order is:

One way to use both $10 credits on the same order is:

- Make an order of at least $10

- Before shopping begins, add new items to the cart of at least $10

- Instacart will charge the initial amount upon order placement and then charge additional items separately

Now you have a single delivery with $20+ of items charged as two $10 transactions, and both of your Instacart credits will be redeemed with effectively one order. (Note, you will need an Instacart+ membership for this in order to get free delivery at $10.)

I don’t trust strangers picking produce, so I’m usually going on Instacart to buy things for my cat and will add items to my order this way to use all my credits at once.

$100 Nexus Credit

The $100 Nexus credit covers a portion of the price when applying or renewing for a new Nexus card. Nexus is a trusted traveller program similar to Global Entry and works for both the U.S. and Canada, costing $120 USD for new applicants or renewals.

The Business Platinum will offset that fee by $100 CAD every four years, which is the interval at which a renewal is required.

So is the Business Platinum Card by American Express Worth it?

Doing some simple math, the annual fee is $799, and we can deduct the following annual credits:

- $200 travel credit

- $120 wireless credit

- $240 Instacart credit

- $200 Dell credit

That brings the net annual fee to $39. I did not include the Indeed credit, as that one is not as easy to use as the others, but including it brings the net annual fee down even lower.

There are also non-monetary benefits of holding the card, such as unlimited lounge access to Amex and Priority Pass lounges (although that’s changing in 2027), access to Amex Fine Hotels + Resorts, complimentary Hilton Honors Gold and Marriott Bonvoy Gold Elite status.

The Business Platinum Card also offers the highest referral bonus (for the person referring) at 20,000 MR points per referral. As a point of comparison, the personal version of the card (The Platinum Card) earns just 10,000 MR points per referral.

Takeaway

You’re likely holding onto the Business Platinum Card by American Express for the travel benefits and generous earn rate of 1.25 points per dollar spent on all purchases. However, make sure to maximize all the Amex Offers available to you to come out ahead of the annual fee.