Table of Contents

Points Miles and Bling (blog) contains referral or affiliate links. The blog receives a small commission at no additional cost to you. Thank you for your continued support. Credit Card issuers are not responsible for maintaining or monitoring the accuracy of information on this website. For full details, current product information, and Terms and Conditions, click the link included.

In this article, we’ll take a look at all the forms pre-approved credit card offers come in, their welcome bonus structures, impact on credit score, and other considerations.

What is a Pre-Approved Credit Card Offer?

A pre-approved credit card offer means the credit card issuer has already conducted some pre-screening and determined that you qualify for a credit card. Remember that issuers want as much of “you” (the consumer) as they can get – they want you to sign up for their credit cards, move your spending to their products, and bank with them (and move your mortgage, trading accounts, etc.).

Based on your other credit products, your history with the issuer, and your credit score, the credit card company determines that you are a good candidate for a certain card, and a pre-approval is an invitation to apply.

To Accept or Not Accept

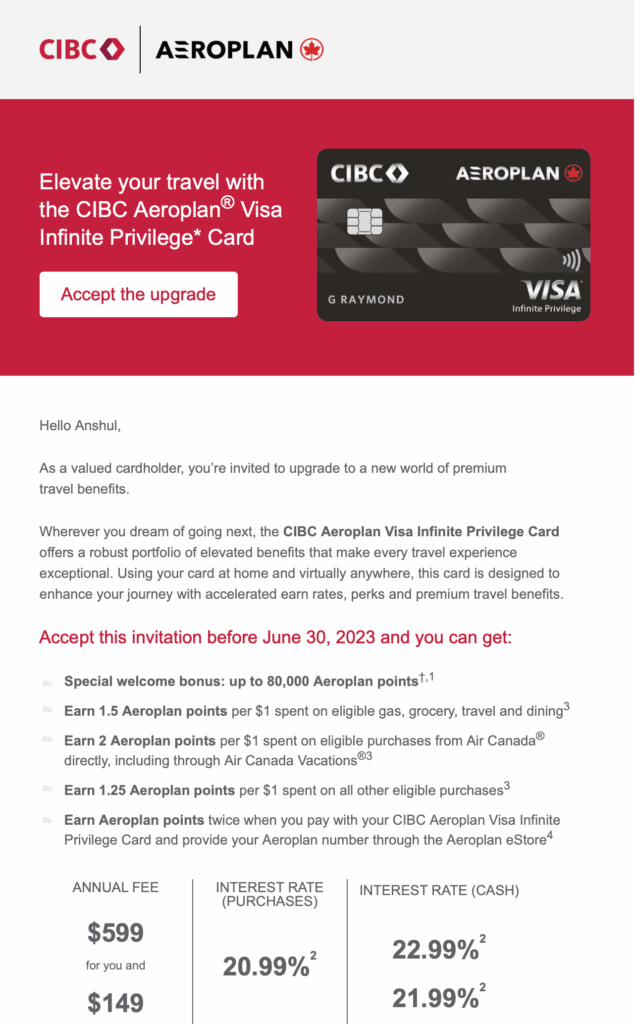

Pre-approved credit card offers are special in that the welcome bonus structure is usually unique – either a unique offer rolling out to existing cardholders to upgrade, a targeted offer only for you, or something of that nature.

Usually, a pre-approved credit card offer means you will be approved for the card and receive the welcome bonus mentioned – even if you’ve already held the card before or are somehow not qualifying based on other terms & conditions (in theory, you can still be declined, but it is rare).

A pre-approved credit card offer means the issuer has already done a soft credit check (that might be just checking your existing accounts with them), and this soft check has no impact on your credit score; namely, it does not show up as an inquiry (hard check).

If your credit card offer is for a new product, you still may or may not be hit with a hard check if you decide to take the offer and actually apply for the card. There’s little reason to accept a pre-approval if the welcome bonus offered is lower than the public offer.

If you are upgrading an existing credit card to a new card with a welcome offer attached, you will not have a hard check, and the new card will also show up on your credit report as an existing credit line, so your credit history is maintained.

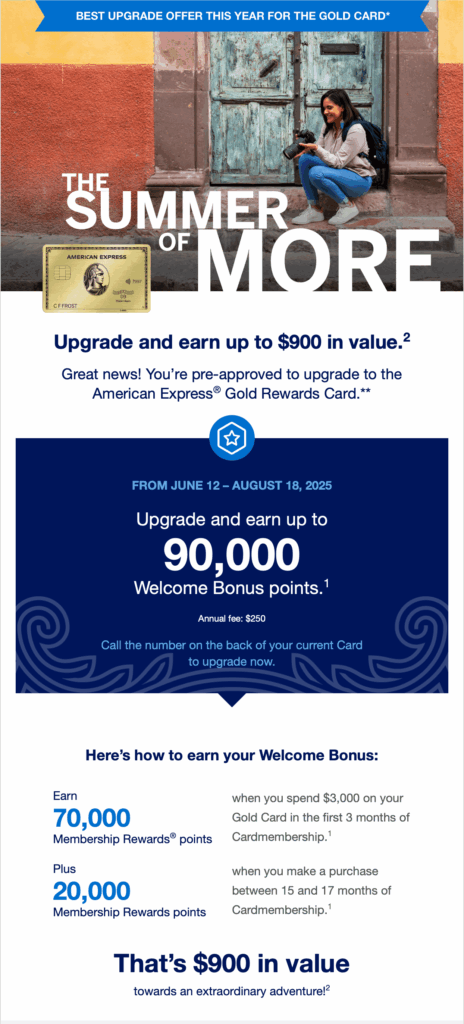

Therefore, whether to accept the card or not does come down to the exact welcome offer attached and your personal credit card use – the screenshot above showed an upgrade offer from Amex Cobalt to Gold, and at the time, this upgrade offer was showing a higher bonus than applying for the Amex Gold as a new applicant. If your goal is to maximize points earned, taking the upgrade offer is the right call.

If the upgrade offer on your existing card is lower than the public welcome bonus, you can weigh the benefits of maintaining your existing credit line and avoiding a hard check over the downsides of receiving a lower bonus . Consider the chances of being approved with a fresh application vs having a pre-approval in hand.

Warnings to Consider

Depending on your personal scenario, taking an upgrade offer like the Amex Gold above may still not be the right call. As the Cobalt earns 5x on food and groceries, you could be leaving a higher number of points on the table than the new welcome bonus if food and groceries is your primary spending category.

If the plan to apply for a new Cobalt after upgrading, consider that Amex has tightened up on approvals in recent months.

Another trap to avoid is when applying for the Avion credit cards. A few months back, I was applying for the RBC Avion Visa Platinum (thinking it’s easier to be approved than the Visa Infinite) and on the final step, I received an offer to upgrade to the Visa Infinite. Assuming this is a pre-approval (this was after clicking “submit”), I clicked yes to the upgrade and … was then declined.

I’m still uncertain of RBC’s goal is with that upgrade screen, and it’s possible I would have been declined anyway on the Visa Platinum (but why offer an upgrade if the original application is declined), so I’ll leave this data point to your own consideration.

Other Considerations

Another more advanced tactic to maximize welcome bonuses is to take the upgrade offer, product switch the card back down, and wait for an upgrade offer to appear again. This works with CIBC on their Aventura line, but as usual, your mileage may vary.

You’ll want to avoid this for Aeroplan co-branded cards, as Aeroplan is strict on the number of welcome bonuses earned per credit card type.

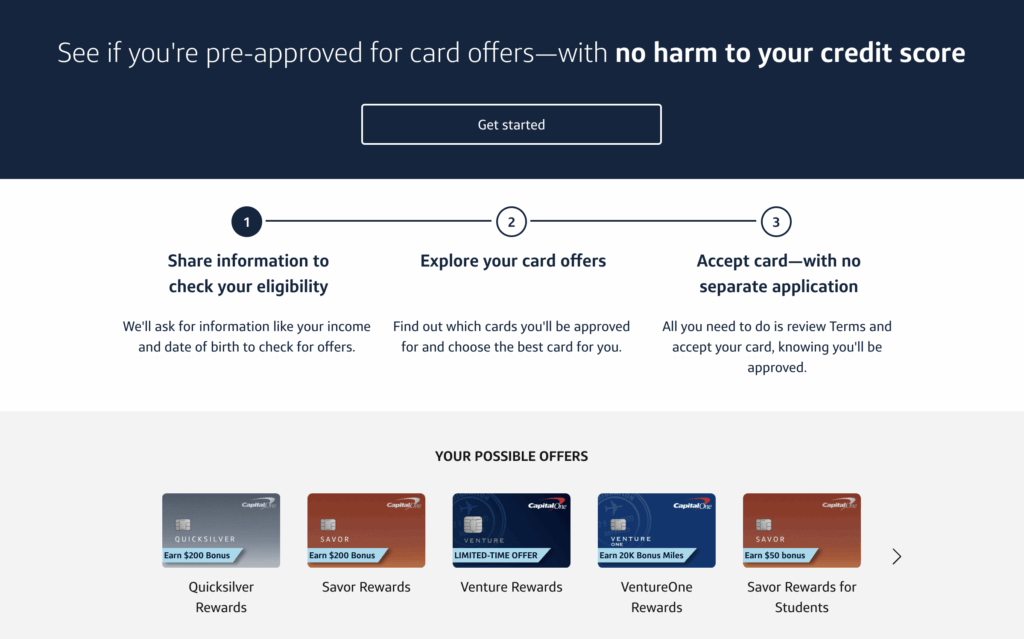

Some issuers like Capital One (U.S.) have a credit card pre-approval tool, making it easier to gauge your chances of approval without undergoing a hard check.

Capital One pre-approval tool

Takeaway

Each pre-approved credit card offer is worth your consideration in determining whether it is worth it to apply.

Should the welcome bonus of your upgrade offer be equivalent to or higher than the public offer for your existing card, taking it means no credit check and no new credit line on your file. On the inverse, you’ll have to weigh the pros and cons of receiving a lower bonus vs a near-definite chance of approval.

For a brand-new credit card, the main consideration is if the welcome bonus is higher or lower than what’s offered publicly. If lower, it’s best to pass.

Regardless of what pre-approval offer you receive, the most important consideration is your personal earning and spending patterns – what purpose does the new credit card fill in your wallet, and will you need the card you’re moving away anytime soon?