Table of Contents

Points Miles and Bling (blog) contains referral or affiliate links. The blog receives a small commission at no additional cost to you. Thank you for your continued support. Credit Card issuers are not responsible for maintaining or monitoring the accuracy of information on this website. For full details, current product information, and Terms and Conditions, click the link included.

I’ve recently had the pleasure of experiencing four colossal mistakes in the points and miles game that resulted in a loss of over half a million points. Why? Simple, I got lazy. Here’s how the losses stack up:

- Late US Amex Payment – $39 late fee and more

- Bonvoy Points Expired (-149,000)

- American Express miscalculation for welcome bonus (-165,000)

- TD First Class Visa miscalculation for welcome bonus (-200,000)

Quite epic, isn’t it? Especially to a veteran who’s been in the points and miles game for over a decade. Why did this happen? Who can I blame other than myself? I’ll blame it on the Covid-19 pandemic that brought us many monstrous earning opportunities (credit card offers, manufacturing spending opportunities, credit card multiplier mistakes, etc.) over the past three years. This ramp-up of earnings meant there were more credit cards and loyalty programs to manage in the portfolio. I had a system to manage them all, but the system failed.

I’m writing this post as a reminder to all to stay on top of your credit card and loyalty accounts to ensure you don’t make the same mistakes I did.

If you’re wondering if I rectified my failures, you’ll have to keep reading. 😊

image by moneymax.ca

Credit Cards – Late Payments

Staying on top of credit card payments is critical. I know this is obvious, but let me ask you, how are you paying, and how quickly are you making your payments?

- Automatic withdrawal from your bank account?

- Making a payment manually as soon as the statement becomes available?

- Making a payment manually payment close to the due date?

If you’re manually making your payments, this is where slip-ups can occur. This is especially true if you’re juggling multiple credit cards and paying near the due date.

In my case, I was trying to avoid a CAD–>USD foreign exchange for a large US American Express payment as I had funds being deposited from another source directly in US dollars into my US bank account. This timing was going to line up close to the due date, and I decided to wait it out. The problem was that I was also traveling during this time, and by the time I remembered, I was one day late with my payment. And the repercussion from American Express:

- $39 late fee

- Membership reward points were not awarded for purchases

- Lost the ability to refer from the account

- Interest charge incoming on the following statement

- Potential negative hit on the credit

Fortunately, I could talk to American Express, and given my good track record with them, they reversed the late payment that brought my account back to good standing. Banks will often do this but only once a year at most.

Tips:

- Set up alerts from American Express and other banks to notify you of upcoming payment due dates.

- Use an application like mint.com to stay on top of your accounts and payments

- Set up automatic withdrawals for all your accounts.

- Cut down on the number of credit cards – If you must wait for funds to pay in full, you have overextended yourself

Amex Payment Reminder

Credit Cards – Welcome Bonuses

Welcome bonuses from credit cards are how most folks accrue lump sums of points. They are awarded after meeting a specific spending requirement within a given timeframe, often 90 days. Finishing the spending requirement as soon as possible is best rather than dragging it out. However, some credit cards have a very high Minimum Spend Requirement (MSR), and it’s understandable to take longer than a few days to complete (e.g. US American Express Business Platinum $15,000 MSR). In such cases, spending must be tracked diligently.

So how did I miscalculate and lose out on the welcome bonus points (Amex 165k and TD 200K)

- I had nine new credit cards for which I was simultaneously doing minimum spending.

- I lost track of the 90-day spend window and accidentally dragged out the spend on one of the cards to 93 days.

- Returned an item that resulted in a credit posted after 90 days. The welcome bonus was subsequently clawed back.

- I assumed the promotion terms and details were the same as a previous promotion. That is, I thought the MSR on the TD First Class Visa was $1000 and not $1500.

Did I find a recourse to get my points? No

I’ll share some tips. Some may be obvious, but it’s always good to have a refresher:

- Try to time getting new credit cards with large upcoming expenditures. This can ensure that your MSR will complete sooner rather than later.

- If you think you will return an item, use another credit card.

- If you plan to return an item beyond the minimum spend window, ensure you first spend that same amount or higher before returning to avoid clawback of the welcome bonus

- Always spend slightly over the minimum spend requirement.

- Remember that the Annual Fee does not count towards MSR.

- Ensure you know when the MSR window begins. For US American Express, it’s the day of approval.

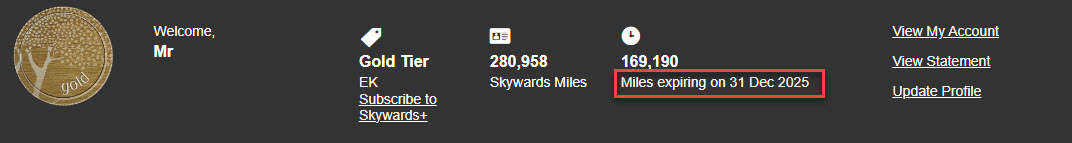

Hotel and Airline Points

Tracking hotel and airline points expiry is tricky if your points are diversified across multiple loyalty programs. Some are kind enough to remind you of expiring points, but most aren’t. Emirates, for example, shows how many points are expiring and when every time you are logged in. Marriott Bonvoy has a 24-month expiry but provides no reminders.

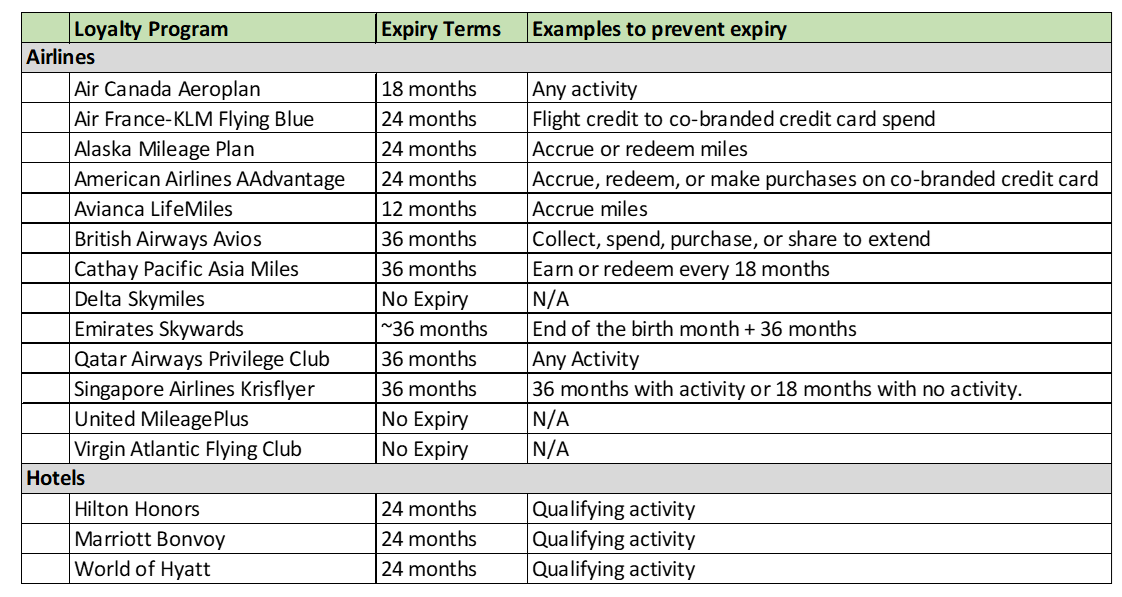

Here’s a table that lists the popular loyalty programs and their expiration policies:

As you can see, most programs have some expiry of points between 12-36 months. It’s straightforward to prevent the expiry of points by doing a simple qualifying activity, but if you have balances across many of these loyalty programs and for multiple people in your household, this is when slip-ups can begin to occur. This is precisely what happened to me.

As you can see, most programs have some expiry of points between 12-36 months. It’s straightforward to prevent the expiry of points by doing a simple qualifying activity, but if you have balances across many of these loyalty programs and for multiple people in your household, this is when slip-ups can begin to occur. This is precisely what happened to me.

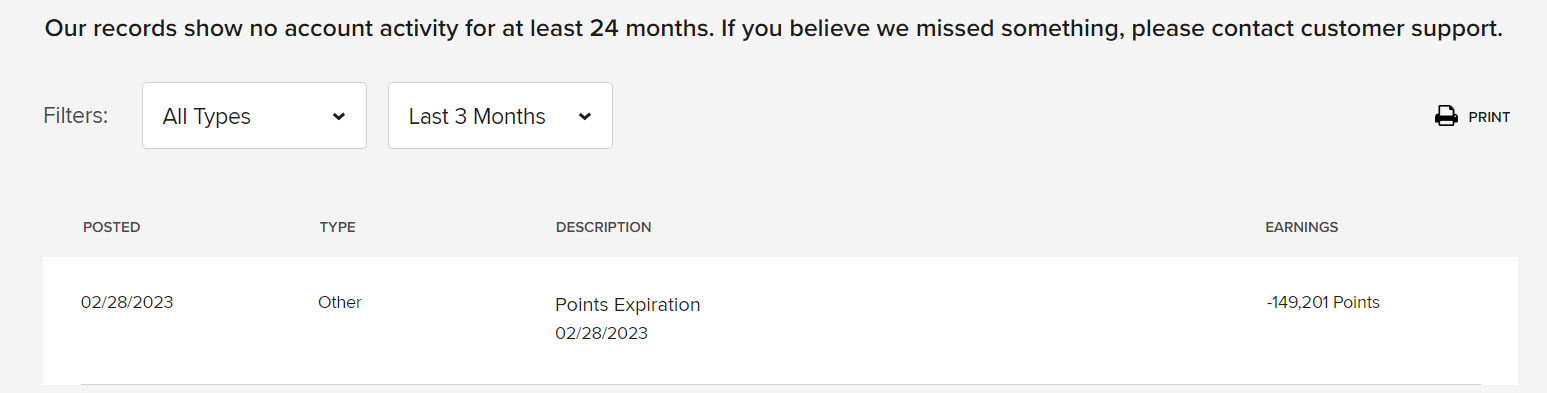

A member of my “household” whom I manage an account for recently had 149,000 Bonvoy points expire. It was an unused account that I was using yearly to transfer 100k a year to my account. As such, no activity was performed other than the points transfer, which is not a qualifying activity to prevent the points from expiring. After speaking with Marriott Bonvoy, it was evident that there was no way to get the points back. I had to accept the loss.

Here are a few tips to avoid points expiry:

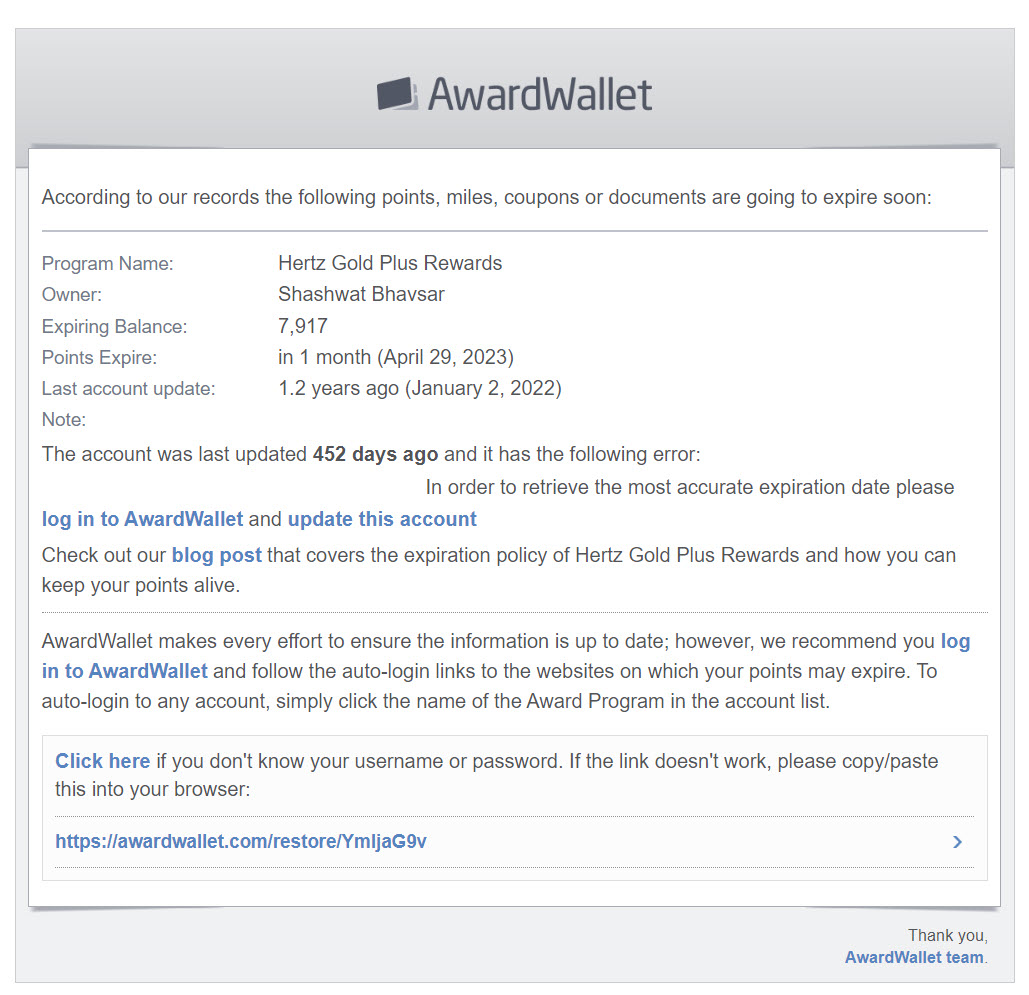

- Use a program like AwardWallet to alert you of expiring points. In fact, I was warned just last week of my expiring Hertz points.

- Set a reminder every few months to manually check all your accounts of expiring points. Programs like AwardWallet aren’t perfect, and a manual audit is occasionally essential.

- Understand methods to extend expiry. Sometimes a simple grocery purchase or points transfer will extend the expiry date of your points.

- Don’t speculatively transfer points to award programs from sources like American Express Membership Rewards.

- Don’t hoard points; earn and burn!

Bottom Line

The origin of my mistakes stemmed from overextending myself. Nothing else. I took on more accounts than I could manage. In the long run, the loss of these points will be minuscule, and it could have been much worse. I have cleaned up my act, canceled a plethora of credit cards, and, most importantly, created a system to stay on top of all my accounts.

The bottom line is, don’t get overconfident, don’t get callous, don’t get lazy, and have a plan to manage your accounts and stick to it.

Title Image: by spycloud.com

4 comments

Seasoned veterans still makes mistakes here and there. I’ve been playing thi since 2015 and I don’t know how many signup bonus I’ve gotten over the years… hundreds of hundreds I bet, currently sitting on over 10 million miles and points. Last year I took adventage of a150k amex platinum business offer but so used to the pendemic era 6 month spending period on personal cards, I just forgot that I had to spend $15k in 90 days for business card.I didn’t realize this brain fart untill I met $15k spend in 120 days. another one, 60k points for opening Amex business account last December… but forgot that I had to deposit $5000 initially within days of opening it. It was so easy to do yet I just didn’t read the fine print or forgot to do required activity. Right there is almost quater million of MR points. That’s over $3000 USD worth of points minimum (@1.5cpp)

Thanks for sharing. Glad I’m not the only one making these mistakes.

Great advice, Sash! If it can happen to you, it can happen to anyone. Thanks for being so open about your screw ups.

Appreciate the feedback, thank you