Points Miles and Bling (blog) contains referral or affiliate links. The blog receives a small commission at no additional cost to you. Thank you for your continued support. Credit Card issuers are not responsible for maintaining or monitoring the accuracy of information on this website. For full details, current product information, and Terms and Conditions, click the link included.

The Rogers Mastercard® offers compelling benefits, making it a must-have for Rogers, Fido, and Shaw customers. Arguably the best no-annual-fee card in Canada, it comes with a generous welcome offer that gives you 10% cash back on initial purchases and unlimited 2% cash back on all eligible purchases. The card combines a strong earning rate with boosted redemption features to create a financial tool that rewards loyalty and enhances connectivity across borders. Let’s look at four substantial reasons why you should consider having this card in your wallet;

- Welcome bonus:

Rogers, Fido and Shaw customers can unlock significant rewards and savings with the Rogers Mastercard, starting with a substantial welcome bonus of 10% cash back on the first $1,000 of eligible purchases in the initial three months—up to a $100 return. Once the introductory period ends, the ongoing rewards include unlimited 2% cash back on all eligible purchases linked to your Rogers, Fido, or Shaw services and purchases made in U.S. dollars. All other eligible purchases earn a consistent 1% cash back. - 1.5x Reward Boost:

Rogers Mastercard is no annual fee card with meaningful rewards. The card offers 1.5x more cashback every time you redeem for Rogers purchases. These can be significant savings on monthly bills or purchasing new gadgets and accessories.

Rogers Mastercard – 30% Rewards Boost

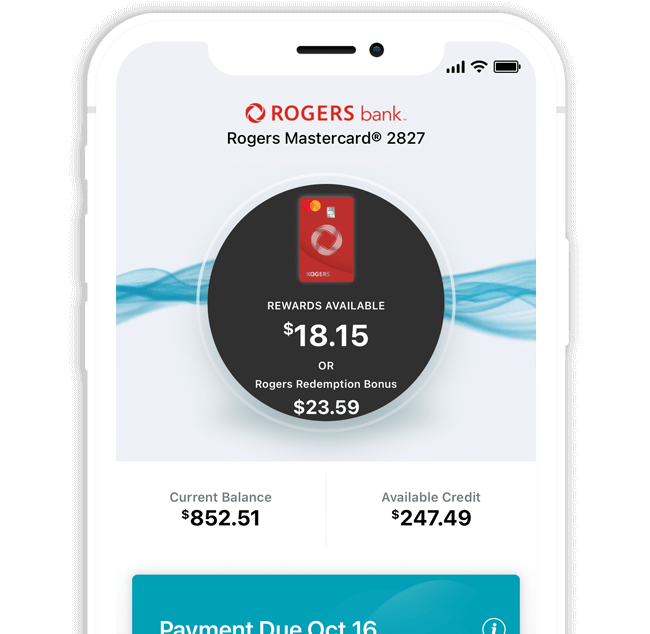

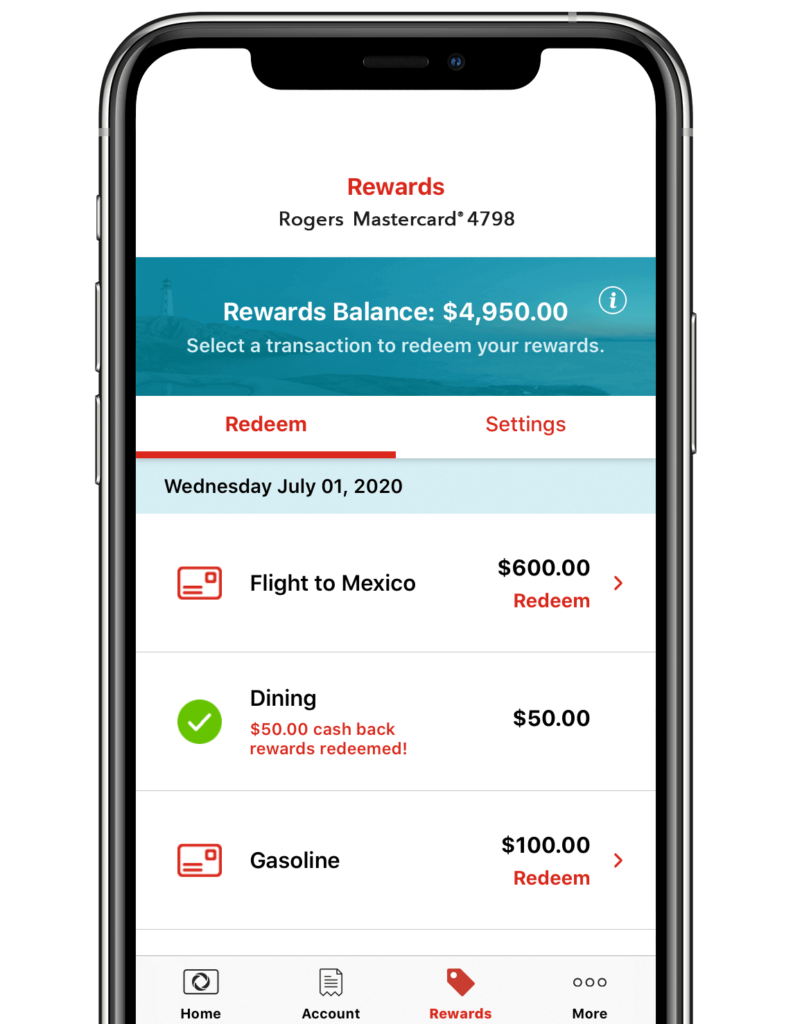

The Rogers Bank app also offers a clean and straightforward interface for members to apply cash-back rewards to any card purchase over $10.

Rogers Bank app interface

- Free ‘Roam Like Home’ days:

Rogers’ Roam Like Home perk lets you use your phone plan’s data, talk and text as you do at home in over 185+ destinations worldwide for a daily fee ($12/day in the U.S., $15/day in other eligible destinations). Rogers Mastercard offers five ‘Roam Like Home’ days annually for Rogers mobile customers, allowing talk, text, and data usage in over 185 international destinations without additional charges, a feature valued at up to $75. - Equal Payment Plan at 0%:

For those planning a new phone purchase, the Rogers credit card facilitates an Equal Payment Plan at 0% interest over 36 or 48 months, bypassing the need for a mobile contract. This feature alone could make the Rogers Mastercard® an intelligent choice for tech enthusiasts looking to spread out the cost of their devices.

Special Promotion for Toronto Transit Commission (TTC) riders: Rogers Bank cardholders who tap any Rogers credit card using a mobile wallet can get five free rides on the TTC between Nov 1 and Dec 31.

Takeaway

Thanks to the MasterCard network, the hidden reason to have the card could be the potential to earn unlimited 2% cash back on all your Costco purchases—the Rogers Mastercard packs significant savings potential for the savvy Rogers, Fido and Shaw households.

5 comments

I use my employer’s iPhone, and the company has a Rogers corporate account. I use Roam From Home a lot, and then reimburse the company. Would I be able to use these days on a phone that isn’t in my own name?

(Terms: ” Access your Roam Like Home days when your Rogers account is linked to your Rogers Mastercard. Only one Rogers Mastercard can be linked to one eligible Rogers mobile account. You must be the primary account holder or a Level 1 Authorized user for the eligible service. ” )

I don’t think it would work on a corp plan. The account must be registered to the same name as on the credit card, as you shared from T&C. I have a corp phone as well, and everything gets billed to my employers account, even though it has my name on it.

For some reason (very annoying) the 5 roam like home perk does not apply if you are a Fido customer. I got fooled since I am a Fido customer and got the invite. I got the card but when I went to link it I was told that perk is only for Rogers customer.

Smells of false advertising since I got an email invitation as I Fido customer.

Ouch! I only know Roam like Home to be a Rogers thing. You should definitely contact Rogers Mastercard and see what they can do for you. Hope you have the email they sent you – would make your case much stronger.

There’s no “case” to be made. My full-on escalation today confirmed that this benefit is not offered to Fido or Shaw customers. This trashed the value of the product for me and annoyed me enough to close it the day I activated it.